Trading has been slower the past couple of weeks, as if the market is awaiting a new catalyst. The DXY is technically bullish and remains so above the 91.45 currently.

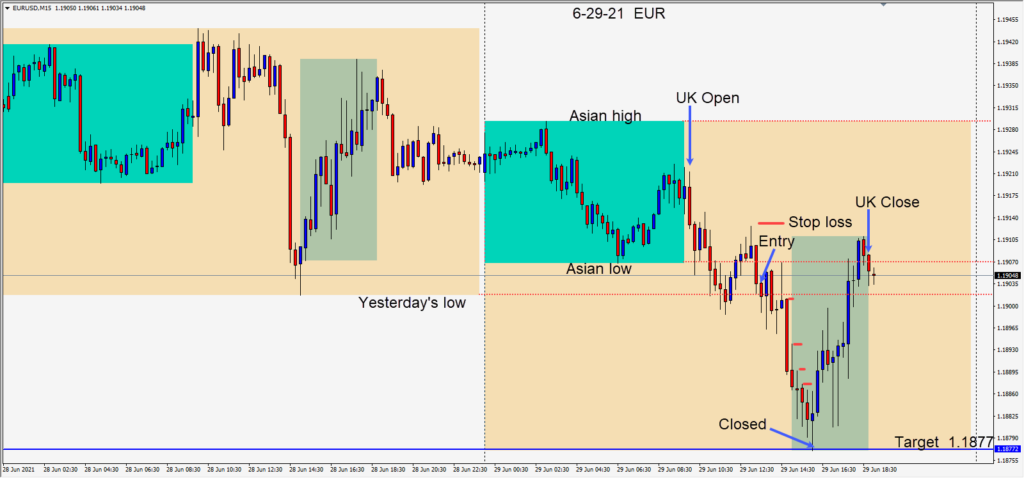

My preferred pairs to trade have been the GBPUSD and the USDCAD, but I haven’t had any runs over 20 pips the past 2 weeks. Today however the EURUSD looked good. Early in the U.K. session the pair moved below its Asian session range and dipped just beneath yesterday’s low before pulling back into its Asian range. As it broke lower a second time beneath its Asian low, a short was taken risking 10 pips for a potential 26 pips to our daily target at 1.1877.

A 10 pip stop loss is not much of a hit if the market goes against you, as long as you’re using proper money management. It took an hour or so before the pair moved lower and it retested its Asian low one more time before it did. Going into the U.S. Open, we moved our stop loss lower taking the risk out of the trade. Long lower wicks began to appear indicating buyers were entering, so we moved the profit stop down to lock in profits and fortunately price moved to our target where we exited just in advance of a pullback.

At times the market has tighter ranges and lower volumes but trades of 10 and 15 pip gains really add up over time with proper money management.

Good luck with your trading!