On Wednesday the DXY moved up to test its July 21st high at 93.19 and failed to move higher leaving a double top. Today the DXY moved lower after the Michigan Consumer Expectations and Michigan Consumer Sentiment economic releases – which were both large misses.

The sentiment today was bearish as the DXY was unable to remain above 93.00… which opened up its fall for a test of the swing high from March 9, 2021 at 92.50.

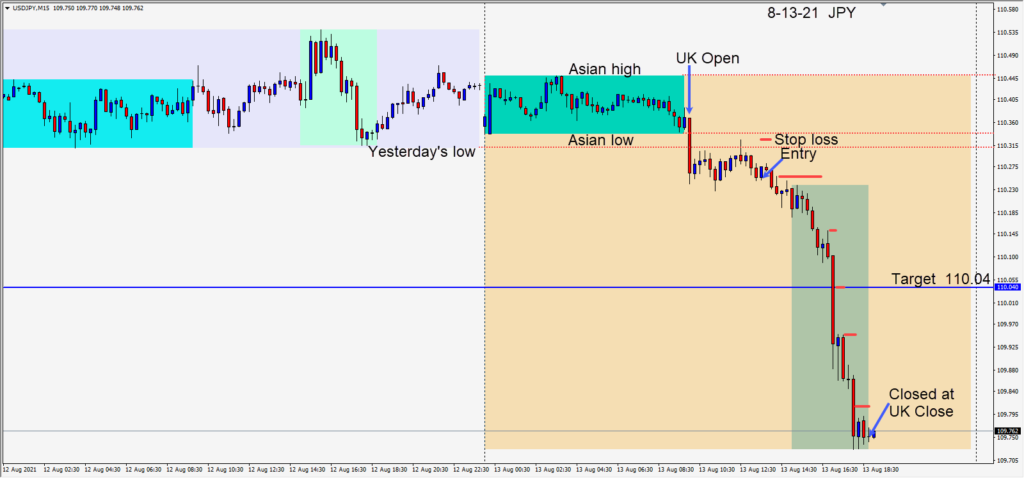

The USDJPY had moved lower as the U.K. session got underway and traded beneath its Asian session low and yesterday’s low for the first half of the session. A short was taken at 110.25 with the intention of getting down to just above the important 110.00 figure. This required a stop loss of 9 pips for a potential 21 pips to our daily target at 110.04.

I find this pair tends to move quite well in the U.S. session but today’s setup looked inexpensive to enter and had it only moved down to our daily target, I wouldn’t bother to write this one up.

Fortuitously after the disappointing Michigan releases, the pair not only moved down to our target, it took out the 110.00 figure and kept descending. We moved our profit stop to protect our target level and kept tightening it down, exiting the trade at the U.K. close.

A trade in any of the majors against the USD could have been rewarding today and Fridays remain a favourite trading day for me.

Enjoy your weekend and good luck with your trading!