We have moved into the second half of September now and daily trading ranges continue to be much tighter than usual. September so far, looks a lot like August. The GBPUSD and the USDCAD continue to be my favourite two pairs to trade because they offer the best daily ranges of the major pairs. With oil continuing to trend higher, the CAD crosses also offer good trading ranges.

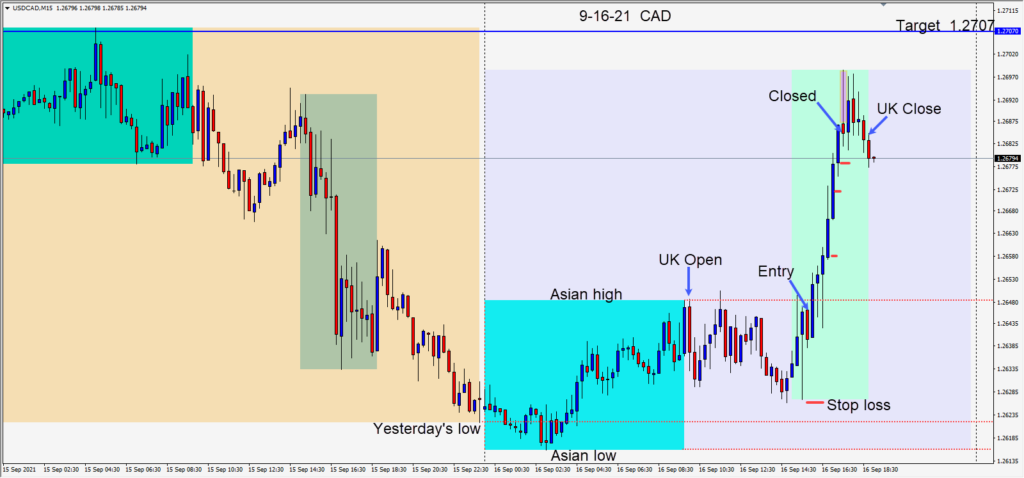

With a very strong U.S. dollar today, an entry long was taken in the USDCAD after the first round of economic news releases in the U.S. session… risking 20 pips for a potential 61 pips to our daily target at 1.2707.

As price moved higher approaching the 1.2700 figure, sellers emerged and the pair closed bearishly lower, leaving a long upper wick and we exited the trade.

With the current trading ranges being tighter than usual, it can be trickier to find trades that run more than 20 pips. With that in mind, money management is always critical to a trader’s success.

Currently, I like to use a smaller risk percentage per trade with a slightly larger stop loss. That may sound contradictory, so this is what I mean… instead of risking 1% on a trade, I will often risk less, for example .5% per trade. When the ranges are constricted, I don’t want a large institution to be able to move the market enough to take me out easily because my stop loss is too close to the market when I enter… so if I normally am comfortable with a 15 pip stop loss, I may opt for 20 pips when I first enter. Avoid trading at low volume times of the day too, so you will be less vulnerable to being stopped out.

It’s a tricky market currently, but it is tradeable and trading the more active major pairs is a safer way to trade it.

Remain disciplined and patient.

I don’t publish trades that are under 20 pips, but I have had a lot of them lately and they add up.

Good luck with your trading and be nimble!