Today was an active day despite the pending FOMC statement. I thought trading might be slow today while the market awaited the FED outcome, but it was active and the Canadian dollar was very strong… as was oil.

The overall sentiment of the market was “risk on” as was evidenced by the equity markets in Hong Kong, Europe, London and subsequently the U.S.

The markets have been active this week and the summer doldrums appear to be behind us.

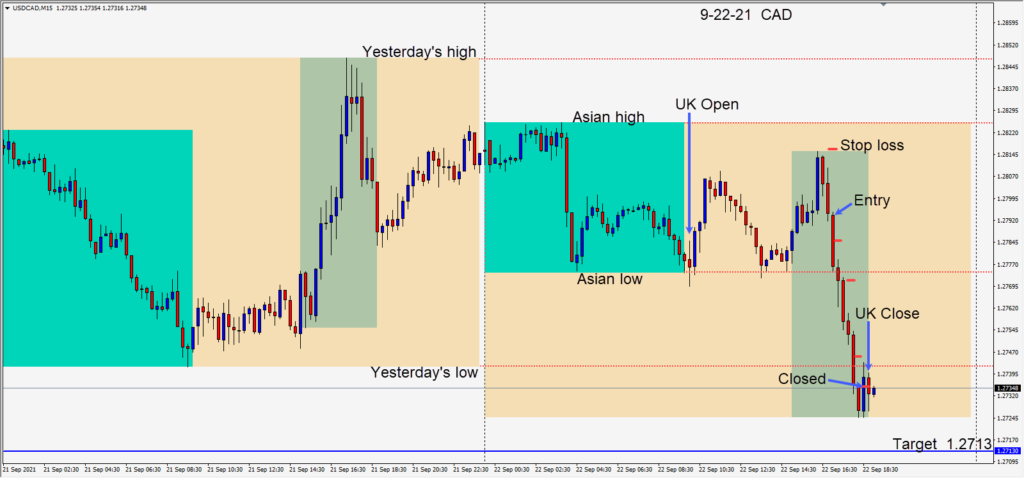

The USDCAD attempted to move above the 1.2800 figure early in the U.S. session and failed. After two bearish candles, a short was taken risking 22 pips for a potential 81 pips to our daily target at 1.2713. Price moved lower passing through the mid-figure then had a one candle pullback 30 minutes before the U.K. close, which triggered our profit stop taking us out of the trade.

The active USDCAD remains my current favourite pair to trade and the GBPUSD is my second favourite.

The market is currently very short the Aussie which can mean an abrupt reversal when the sentiment begins to change and the shorts rush to the exit door. I’m also trading the EURCAD and CADJPY. My EURUSD trades have been less rewarding and less frequent as the pair remains in a tighter daily range than usual. The USDJPY trading is picking up with the 110.00 level still being a key technical level.

Trading volumes have picked up recently and I hope we have a nice run of active trading for the balance of the year.

Good luck with your trading!