The USDCAD continues to be a rewarding pair to trade, along with its crosses and the GBPUSD.

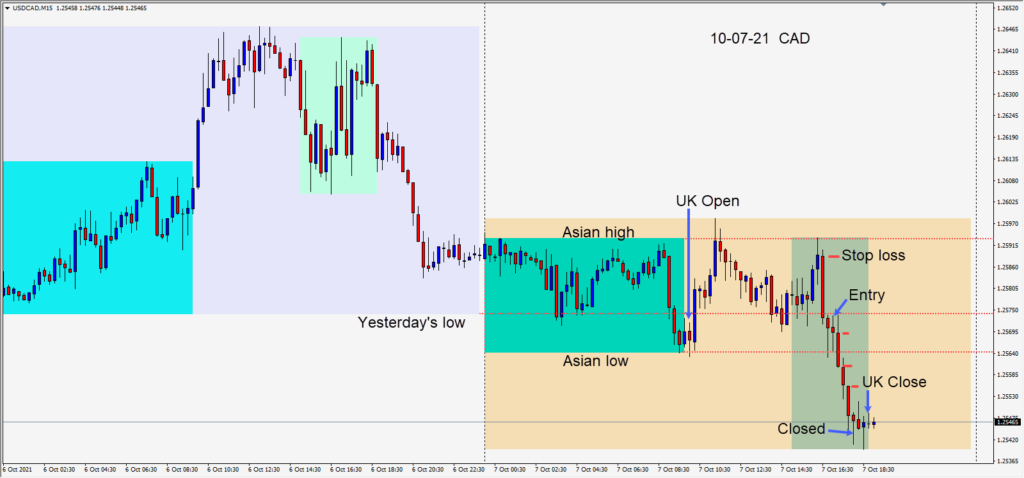

A short was taken today immediately after the Canadian Ivey PMI release risking 18 pips for a potential 75 pips to our daily target at 1.2498 (not shown).

The idea was to take advantage of the “risk on” sentiment and the softer USD today. Similar to what has been mentioned in a previous post, I prefer to short the pair when it sets up and keep an eye on the 1.2550 sticky level. If it attracts more sellers there… I will stay in it and if not I will protect profit.

The pair moved lower and resisted taking out the 1.2550 level at first – which is to be expected. Regardless of your intended target, be aware of the 1.2520 and 1.2500 levels where buyers are likely to appear.

Today when price went through the 1.2550 level, it left a long lower wick. The following candle price attempted to push lower and when it moved up to the low of the previous candle, the trade was closed before it could retest the mid-figure.

The GBPUSD was also a nice trade today.

Tomorrow will be the monthly NFP release and sentiment is widely bullish. If I see an opportunity, I will trade it and if not, I will be back on Tuesday looking for trade setups.

Monday is Thanksgiving Day holiday in Canada and Columbus Day in the U.S.

Good luck with your trading!