The day after Thanksgiving in the U.S. is known as Black Friday and with many traders taking a long weekend, trading volumes are lower. That coupled with negative headlines about the discovery of a new coronavirus variation reported from South Africa’s medical scientists, led to fear and panic in the financial markets around the world… particularly the major equity indices.

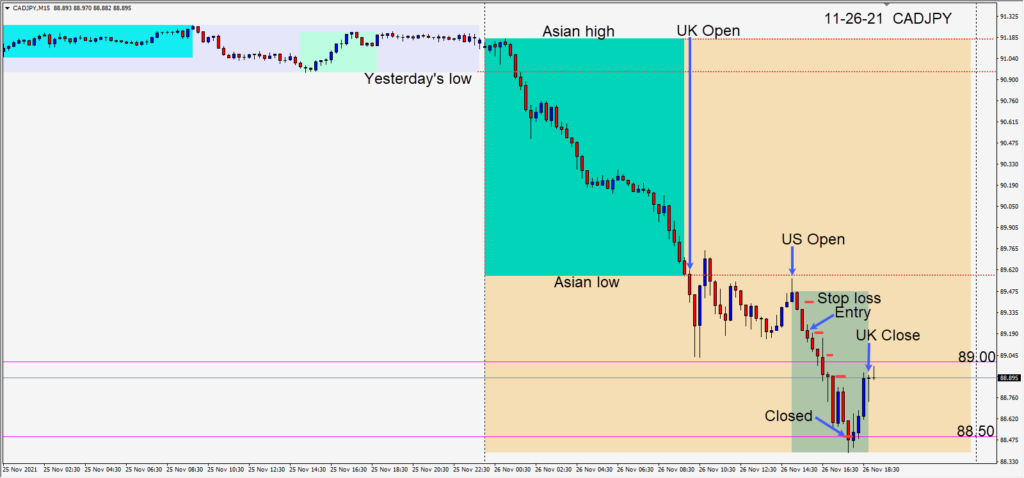

Large moves in currency pairs followed. With oil dropping precipitously and fear benefitting the Japanese yen, a CADJPY short was taken risking 20 pips as it started to move lower after the New York session got underway. It didn’t matter which pair you chose today, the gains were likely good if you had your correlations and direction correct.

With the Canadian dollar being weakened by the drop in WTI Oil, and the Japanese yen benefitting from safe haven status, a short was taken risking 20 pips, which was quickly moved to plus one pip once the move began. The pair continued down to the 89.00 figure. We protected that level, as it continued lower to the 88.50 level. As it attempted to move lower still… it ran into an important technical level from the daily chart. We protected the 88.50 level and our profit stop was hit just before the European close.

Enjoy your weekend and good luck with your trading!