Firstly, I haven’t been posting for a month and not because I’ve been away on a holiday. There was a death in my family and recovering from it has been very emotional for me. At times, I wanted the focus and distraction of trading but trading during emotional periods is not advised. I did the occasional trade but my focus was challenged, so I stepped back and spent more time observing the markets.

So what has changed in the past month? We now know that Jerome Powell will continue on for a second term as the Federal Reserve Chairman. Daily currency trading ranges have contracted in the majors, but the USDJPY is showing more life than it had in the summer and early autumn. Oil remains topical and hence the USDCAD remains active, but less so. Unfortunately, the Covid virus is still prevalent and disruptive… and causing chaos in certain areas of the world.

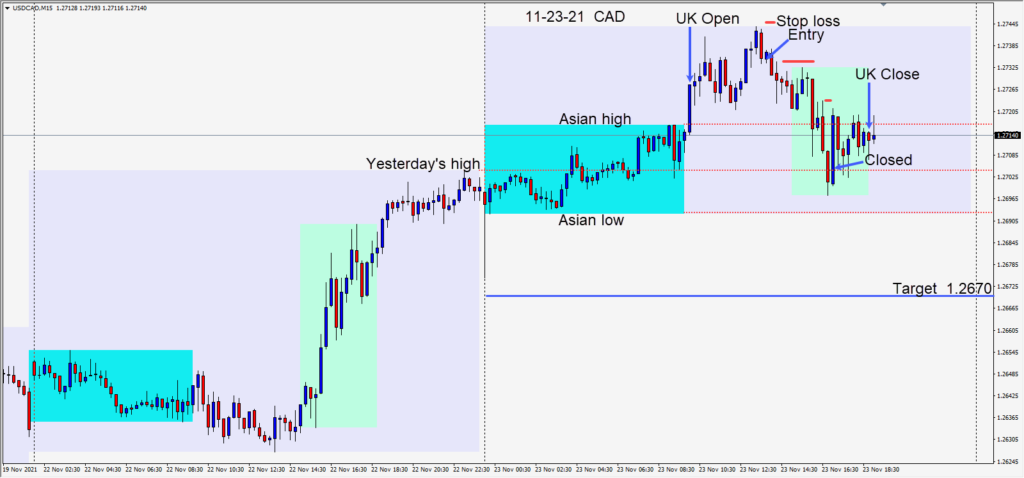

Today, a short was taken in the USDCAD as the pair approached the 1.2750 level and abruptly moved away without actually challenging it. This pair tends to be sensitive to the figure and mid-figure levels and a bearish engulfing candle created our entry setup requiring only an 11 pip stop loss for a potential 64 pips to our daily target at 1.2670. Over the past month, I have found relatively tight risk/reward ratios which have negated a lot of entries. This coupled with smaller moves generally is a good reason to be very selective in your trading.

Today the USDCAD moved lower after entry and our profit stop was moved to plus 1 pip in advance of the U.S. open. After a small pullback, the pair moved lower and was immediately met with buyers at the 1.2700 figure. Not wanting to give back a nice gain, the trade was closed at yesterday’s high.

I have noticed over the past month that locking in at least one pip when a trade moves as expected can save one from the disappointment of having one’s stop loss hit. I let a few trades back up against me despite recognizing that a pair looked like it was reversing and as opposed to closing the trade, I let it hit the stop. reviewing a trade afterward can really help with this. I don’t take any trades that would hurt me if I get stopped out, but locking in profit even if it’s only a pip or two once a pair has moved in your direction prevents a potential loss. It’s a bit of a balancing act but the swings have been less unidirectional than usual and pullbacks along the way are frequent.

Another trick is to take smaller positions, risking less than usual until the market gets active again. If you see a great setup that meets your criteria with the market trending strongly and ranges are less contracted, then consider your usual size of trade.

Good luck with your trading and Happy Thanksgiving holiday to the U.S. traders this week!