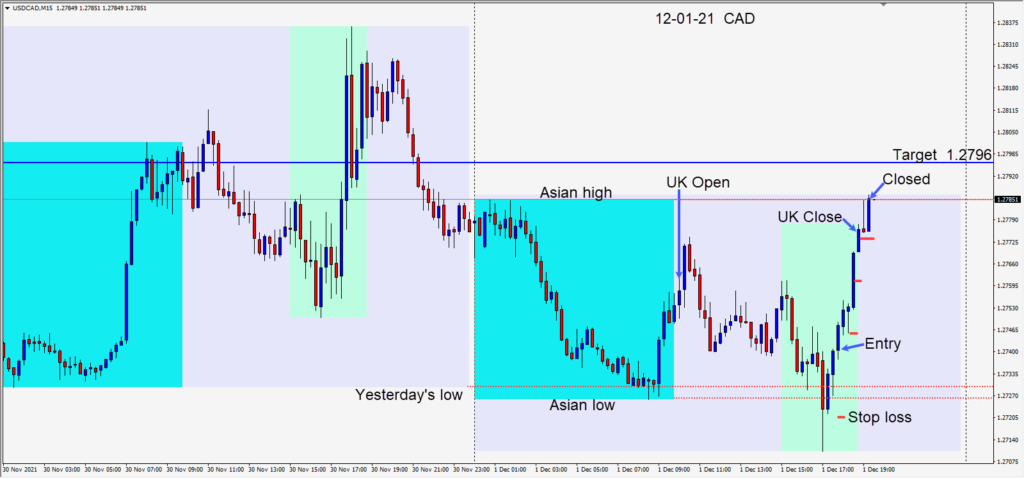

The USDCAD made waves to the downside but found buyers near its Asian session low. As price began to move higher a long was taken risking 20 pips for a potential 56 pips to our daily target at 1.2796. The first level to get through was the mid-figure which this pair respects. The second level was its Asian session high, followed by our daily target at 1.2796 – just below the 1.2800 figure.

I like to be done trading by the end of the UK session, but this pair represents 2 North American trading partners and it tends to continue to move during the North American business day. Today I decided to stay in an extra half hour but closed the trade when it failed to get above its Asian session high. This pair tends to move to our target most days… by the end of the day, but I don’t like to be in a trade if I can’t watch it.

I’m reminded of a story Mark Douglas tells about an excellent trader he was hired to coach years ago. This Chicago trader was technically excellent and other traders were in awe of how well he read the market each day. This trader had one flaw and it was costing him big dollars, so he hired Mark. It turns out in the last hour of this trader’s day, he tended to give back a chunk of his profit. Mark noticed that the trader’s focus waned in the last hour. In other words, if he quit an hour earlier, he wouldn’t be giving back his profits. What made the difference was simply calling it a day an hour earlier and banking his profits until the next day.

Good luck with your trading!