A number of years ago, a friend who manages a large hedge fund, told me that he liked to gauge risk sentiment with the AUDJPY pair. Like many traders, my preference has been the bond market… particularly the US 10Y yield. This gentleman who knew more about JPY trading than anyone I have ever met… before or since equated the AUD strength to risk and JPY strength to safety.

Today before we hear from Fed Chair Powell, I anticipated the currency markets to be like the calm before the storm. In other words, trading in a very tight range. What struck me as unusual was the AUD strength going into the U.S. session. Traders have every reason to be nervous going into the Fed’s potentially extremely volatile decision announcement.

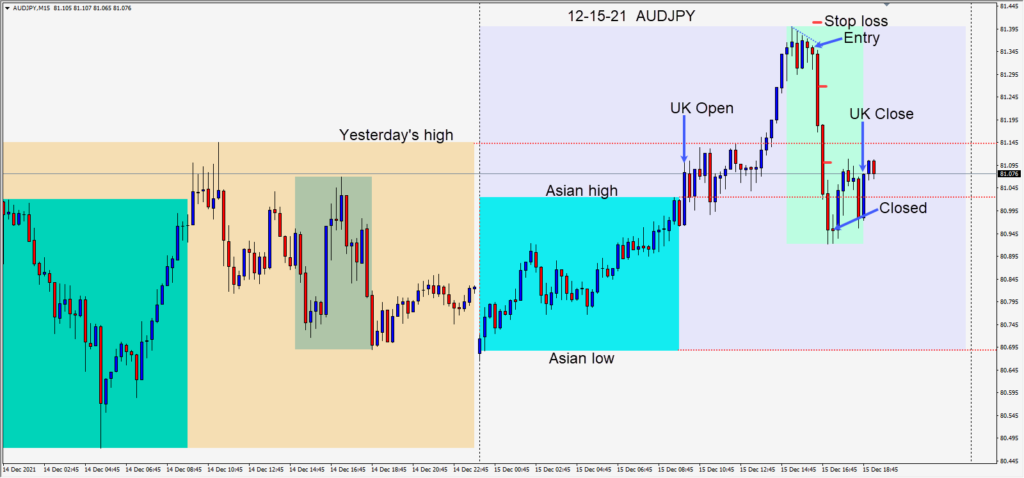

When the AUDJPY failed to move higher and broke 81.35 – a level of interest on the daily chart, a short was taken risking 8 pips. The first level to get through was 81.14 followed by the 81.00 figure and 80.93. The idea was not to be greedy around the figure and any failure to break below 80.93 would likely result in a retest of the 81.00 level.

Further confirmation of the trade’s strength was evident in the CADJPY moving the same direction and the AUDUSD pushing lower in tandem.

On Thursday, the Bank of England, European Central Bank and the Swiss National Bank will announce their interest rate decisions.

Good luck with your trading!