Canada’s economic releases today came in below expectation. As the equity markets continued lower this week, the markets were in “risk off” sentiment… which tends to move flows to the JPY.

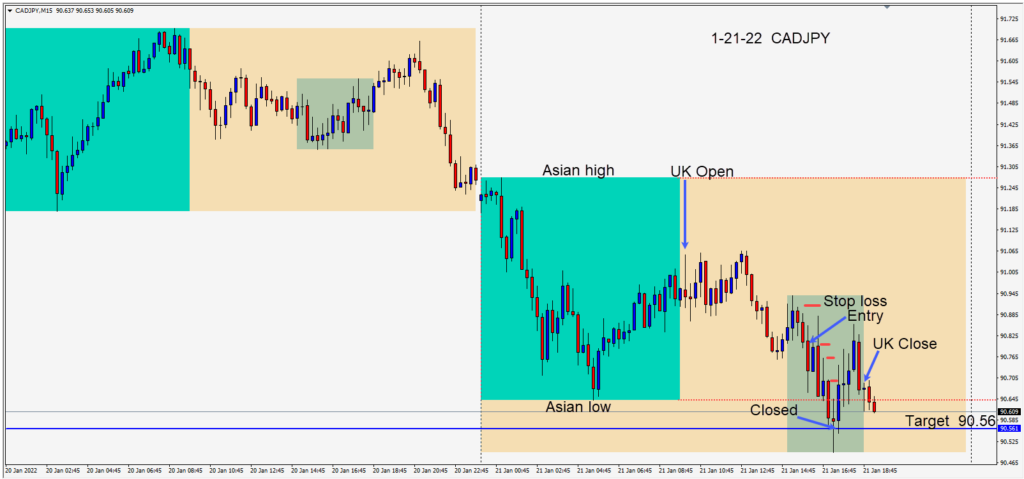

A short in the CADJPY was taken risking 10 pips for a potential 22 pips to our daily target at 90.56. The entry looked like the second drive of a “three drives pattern”. This is usually, but not always, the largest of the three waves. Price made its way lower and the trade was closed at our target.

The up and down volatility is making for trickier than usual trading. If you are up 20+ pips, be careful not to give them back. Removing risk from a trade works well as does locking in profits as your trade moves in the direction of your target. Never let your position go negative if you’re up by 20+ pips.

Good luck with your trading and enjoy your weekend!