The North American traders will be starting effectively an hour earlier and overlapping with the European and U.K. markets for an extra hour this week and next until Europe and the U.K. move their clocks ahead for Daylight Savings Time.

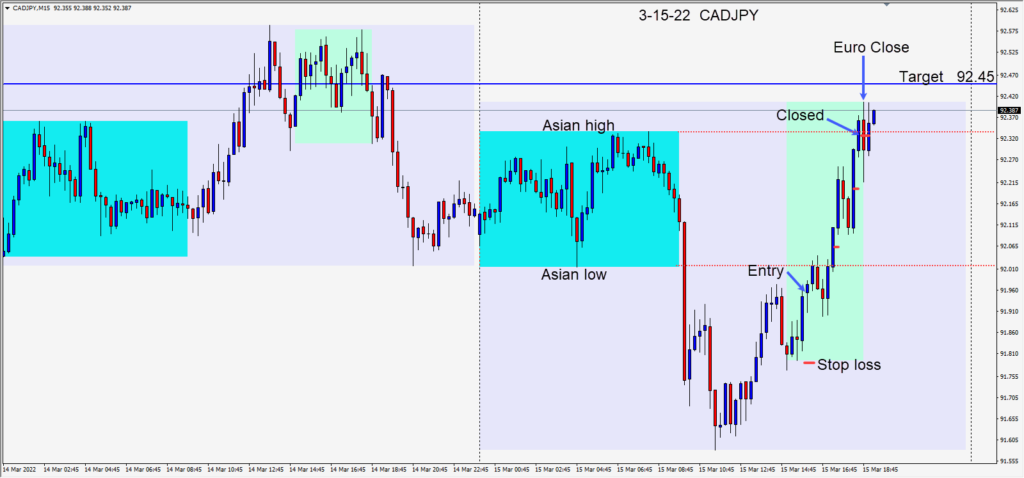

Today after the economic news releases the CAD caught a bid as did the major North American equity markets. With the USDCAD moving lower and the USDJPY moving higher, a long was taken in the CADJPY risking 18 pips for a potential 50 pips to our daily target at 92.45

The first two candle pullback was a retest of two important technical levels before price continued higher. As price continued upward to test its Asian session high, we tightened up our profit stop as the European close approached and the trade was closed.

Wednesday the FOMC interest rate announcement is expected to be a 25 bp increase. The accompanying statement will be telling. With the current very high inflation, the Fed will be walking a fine line attempting to slow the economy gradually without dragging it into recession.

Tomorrow Russia may default on a major bond interest payment which will have further ramification for the fraying Russian economy. China is reported to have said they want to avoid being impacted by U.S. sanctions over Russia’s war.

Good luck with your trading!