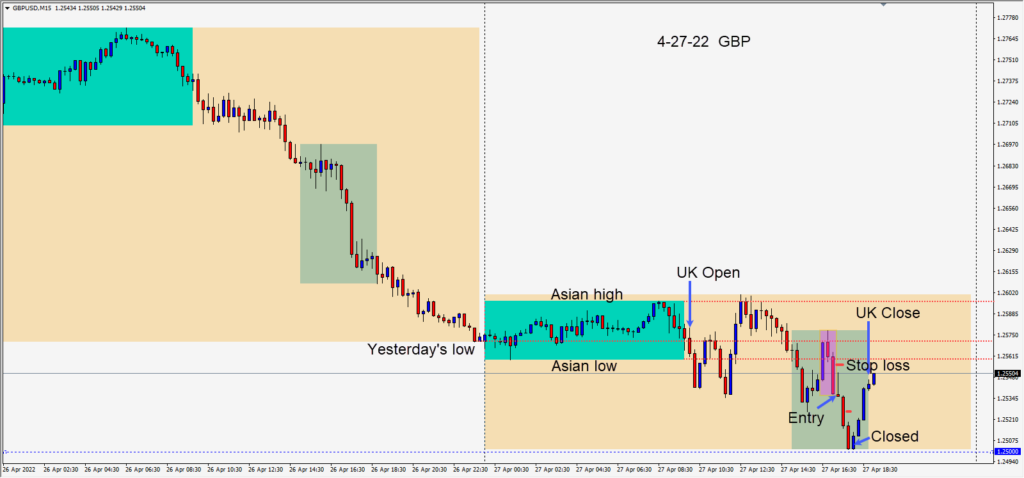

The USD continues its ascent and the GBPUSD continues its descent. Regardless of the chart interval, one can see a series of lower highs on pullbacks.

Today, during the U.S. session overlap as the pair made another lower high a short was taken risking 20 pips for a potential 79 pips to our daily target at 1.2459 (not shown). Price moved lower following a high probability reversal setup. The risk was taken out of the trade after the second candle. At the European close (typically a volatile candle) price was unable to penetrate the 1.2500 figure. It slowed right down and didn’t touch it. As buyers began to enter pushing the pair a little higher, the trade was exited.

Could price continue lower today penetrating the 1.2500 mark… absolutely, but if you’re up 35 pips in a trade how much to you do you want to give back when price is bouncing at a technical round figure? You can always get in again or find another trade. In this example today, price respected the psychological 1.2500 number and buyers entered. I prefer to focus on the pips that I get in my account not the ones that got away. An old friend used to say to me that “fear and greed are a traders two worst enemies”.

One of my preferences for taking a trade is to have a 3:1 reward for my risk or greater. Would I take a 2:1 trade… yes, if I really like the setup. Are these trades hard to find… somedays they are. Do I ever take a 1.5:1 trade… yes, if that is all I can find and the market is slow for a given period. The key here is to have a confluence of reasons for taking a trade, particularly if it has a low R:R. If you find yourself compromising then it’s prudent to take a smaller position size than usual. If the trade works out… great you’ve made some money. If the trade doesn’t work out… you haven’t lost much money. Examples of risk for me, are one quarter or .25% account risk for a tiny trade. One half or .5% risk for a good trade setup and .5% to 1% for a great trade setup. In the current volatile market, my preference is not greater than .5% risk… and I like to get the risk out of the trade as quickly as possible, as the trade moves in my favour.

We never know when we enter a trade how it will work out, but we can limit our risk exposure at entry and further while we are in the trade.

Good luck with your trading!