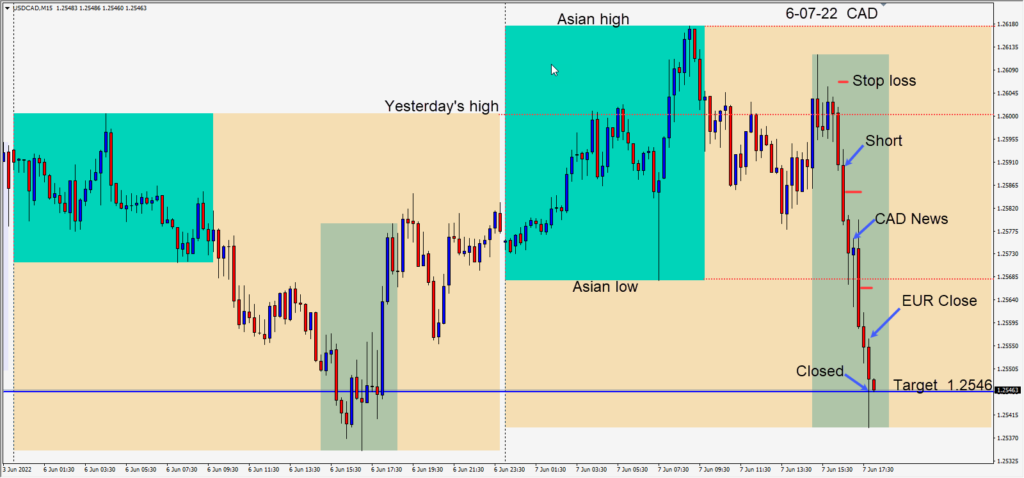

During the first half of the U.K. session the USDCAD made a series of lower highs as it tested and moved beneath yesterday’s high. As the North American session began, it reversed higher but was unable to take out today’s high. As price moved lower through the 1.2600 level once again, a short was taken risking 16 pips for a potential 44 pips to our daily target at 1.2546.

Price continued lower and we moved our profit stop lower, taking the risk out the trade in advance of the CAD economic news release. Price tested its Asian session low for two candles before breaking decidedly lower. The trade was closed at our target just before the European close. The last fifteen minutes going into the European close can be quite volatile as traders take profits.

Be cautious with the USDCAD in the 124.75 area where it may find buyers in the near term. If that level goes, pay attention to the 123.50 area.

I was away from teaching and trading during the month of May due to emergency surgery and required recovery time. I had lots of time to think about why so many traders struggle to make consistent profits in trading. I believe that many new and experienced traders complicate their trading with useless indicators, not used by institutional professionals and are oblivious to what the market is showing them each day. Understanding what to look for, how to spot it, money management and keeping it all relatively simple is the key to long term success in trading. There is no holy grail indicator. More on this in future posts.

Good luck with your trading!