I have been reflecting back on conversations I’ve had over the years with institutional traders about when the EURUSD would reach par or move even lower. Many times a case has been made for the EURUSD to reach par in a given year… but it didn’t. We have a hawkish Fed and a dovish ECB by comparison. Could this be the year?

It was pretty amazing to see the USDJPY definitively break 130.00, then 131.00 and quickly ascend almost 600 pips. The EURUSD moved up to 1.0600 on its recent retracement and has quickly fallen to the 1.0150 area. All eyes are on par once again and there will be some buyers near that level. In the meantime the downtrend continues.

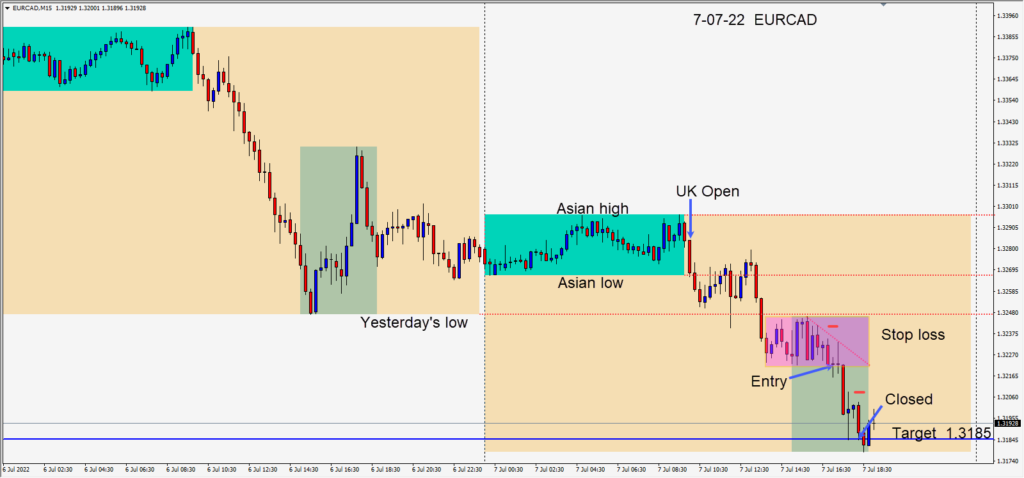

Today, taking advantage of the Euro downtrend came via shorting the EURCAD. The USD was slightly soft but the CAD was showing some strength.

As the North American session got underway the pair was consolidating as it had in the Asian session. When a period of consolidation breaks, price tends to move (but not always) back in its trending direction. A short was taken risking 20 pips for a potential 46 pips to our daily target at 1.3185.

Price moved lower and tested our target level but the spread was 2 pips and the trade didn’t close. On the second test the trade was manually closed.

Tomorrow the event risk will be the NFP release in the U.S. session and ECB President Lagarde will be speaking early in the EUR/UK session.

Good luck with your trading!