In June 2020 Chair Powell stated that the Federal Reserve was “not even thinking about thinking about raising interest rates”. Today he stated, “If the totality of the data were to indicate that faster tightening is warranted, we would be prepared to increase the pace of rate hikes. Restoring price stability will likely require that we maintain a restrictive stance of monetary policy for some time”.

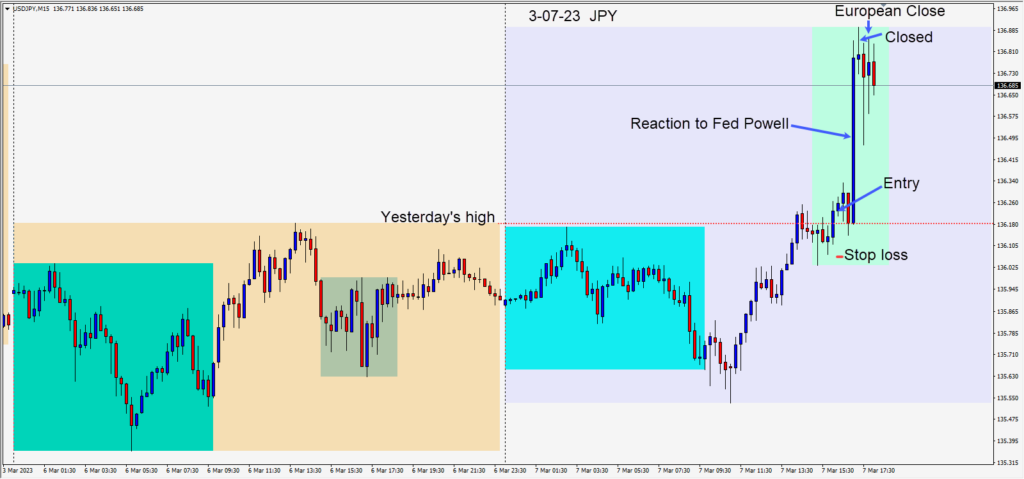

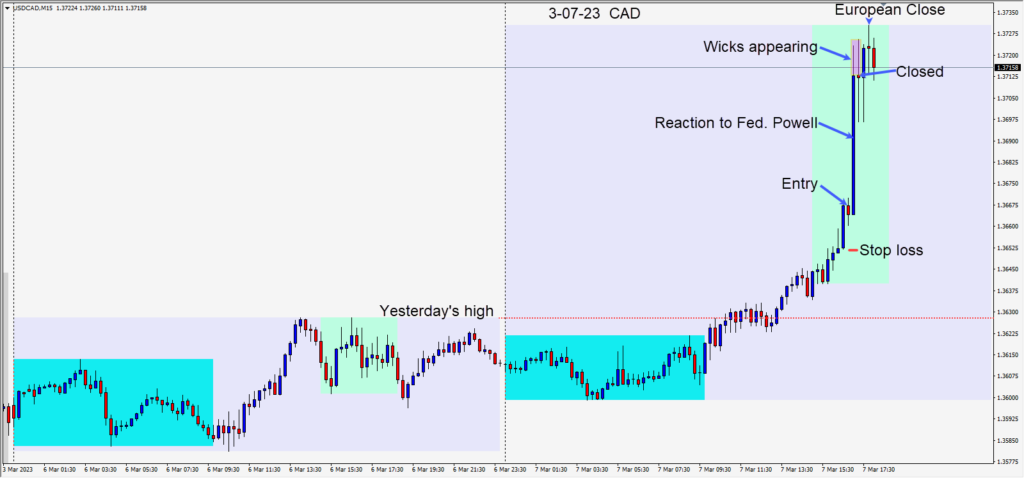

With the resilience of the U.S. economy and plenty of data to suggest it’s still running “hot” long positions were taken in the USDJPY and USDCAD in advance of Powell’s remarks.

It didn’t matter which pair or pairs that you traded as long as you had your risk management correct and anticipated higher rates.

The USDJPY and USDCAD were beginning to move higher as was the DXY.

A long was taken on the USDJPY at 136.24 with a stop at 136.06 and a target area of 137.00

A long was taken on the USDCAD at 1.3669 with a stop loss at 1.3651 and a target area of 1.3729

The strategy was simple. Move to a 5 minute chart and watch the reaction. Fortunately, both pairs moved rapidly higher and the first move was to lock in some profit, the second move was to lock in more profit. The market took me out of both trades at the profit stops and the net was over 100 pips. Remembering the old Wall Street adage that “pigs get fat but hogs get slaughtered”, I was feeling very happy with the trades today.

A former student in England who loves trading the GBPUSD, shorted it at the London open and followed that profitable trade by shorting it again in advance of the Fed… netting over 160 pips today. Nick is an amazing trader who deserves every pip because he has worked so hard to get to this level. He’s very consistent, disciplined and keeps trading simple.

Good luck with your trading!