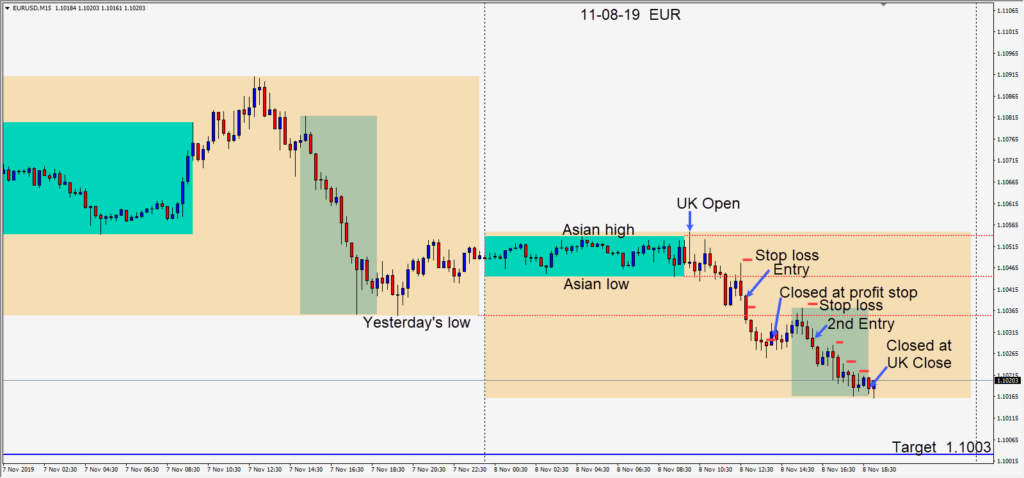

The EURUSD 1.1000 level has been supportive all week. The USD was unable to get any sustained traction higher.

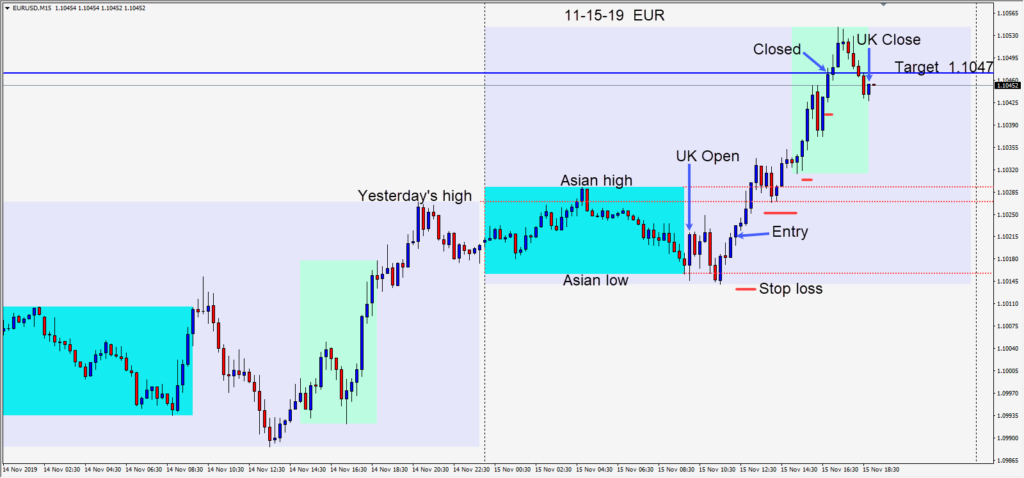

Today the EURUSD began to move higher and a long was taken risking 8 pips for a potential 25 pips to our daily target at 1.1047. The 1.1050 – 1.1065 level is likely to attract shorts on any USD strength… which was not evident today.

Price slowly climbed to test and retest its Asian session high and yesterday’s high in advance or the U.S. open. There were lots of U.S. economic news releases today, so we moved our profit stop up to protect our gains and closed the trade at our target price of 1.1047.

My preference will be to short this pair next week for a retest of 1.1000 on a day of USD strength. With continued USD weakness, my preference will be to go long for a test of the 1.1100 figure.

Enjoy your weekend and good luck with your trading!