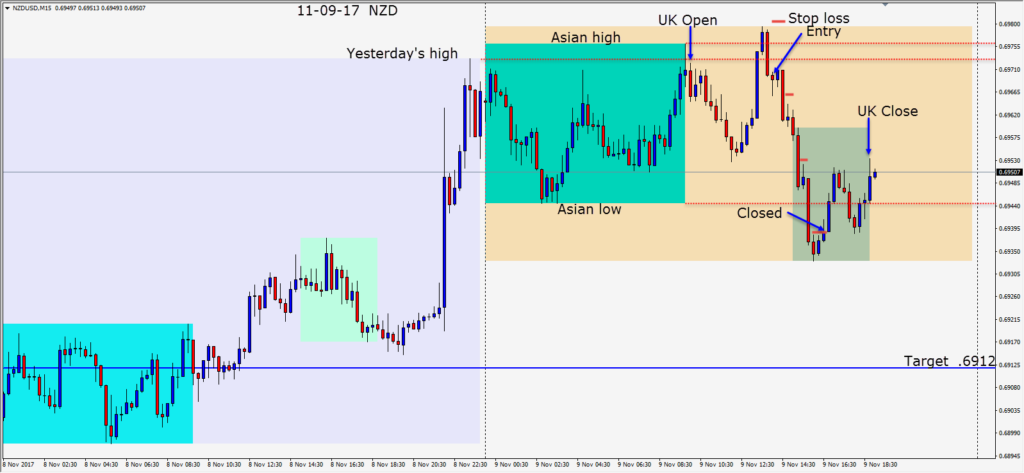

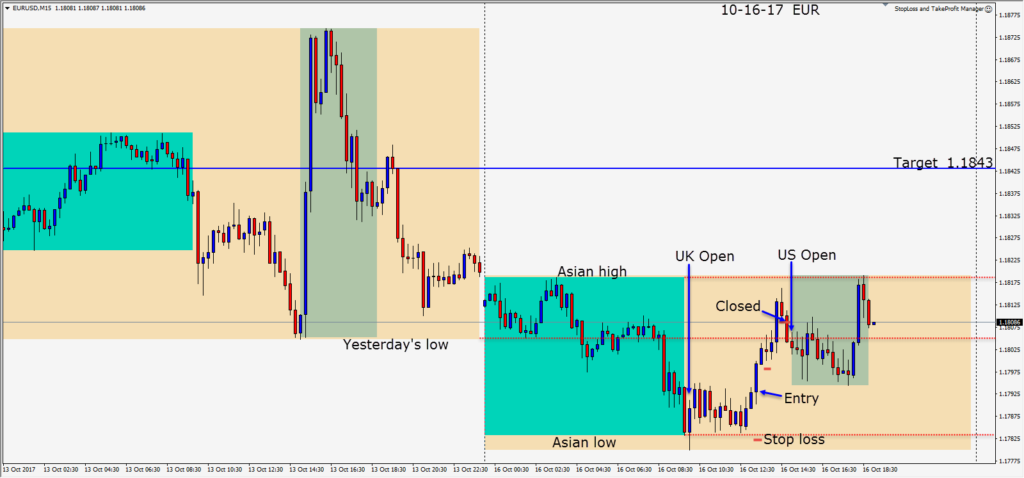

The NZDUSD has been an active pair lately and despite hawkish comments from the RBNZ, we were able to find a nice short setup today. Price tried to climb above yesterday’s high but was unable to remain above.

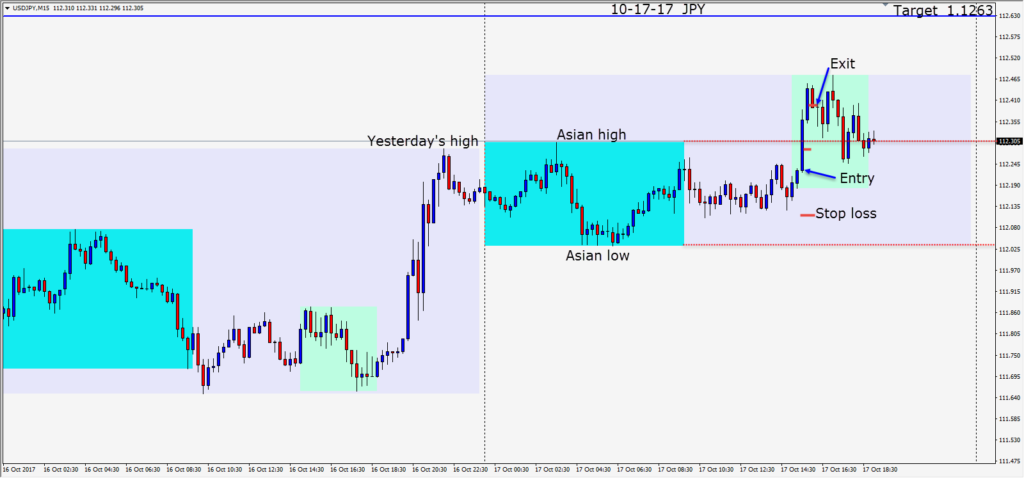

We entered short with an 11 pip stop loss for a potential 57 pips to our daily target. Price hesitated at our entry, but did not retest yesterday’s high. It then began to drop and plummeted right through its Asian low. This level will typically be retested and sure enough price began to move up…hitting our profit stop and closing our trade.

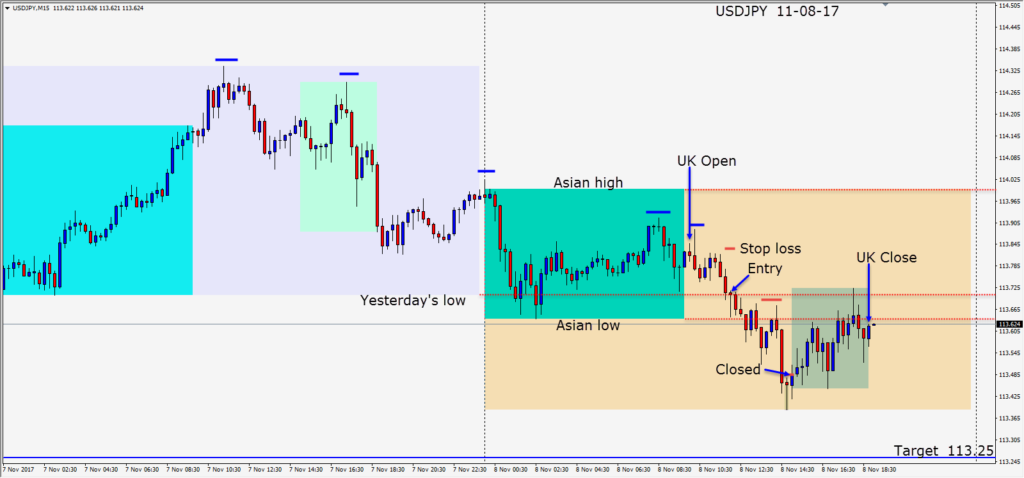

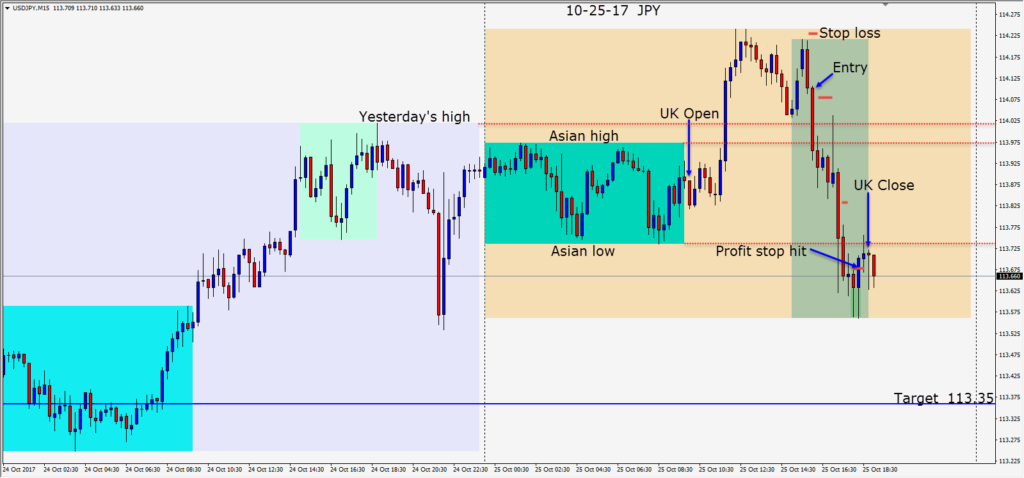

The USD remains on its backfoot again today as politics and tax reform undermine its strength.

Good luck with your trading!