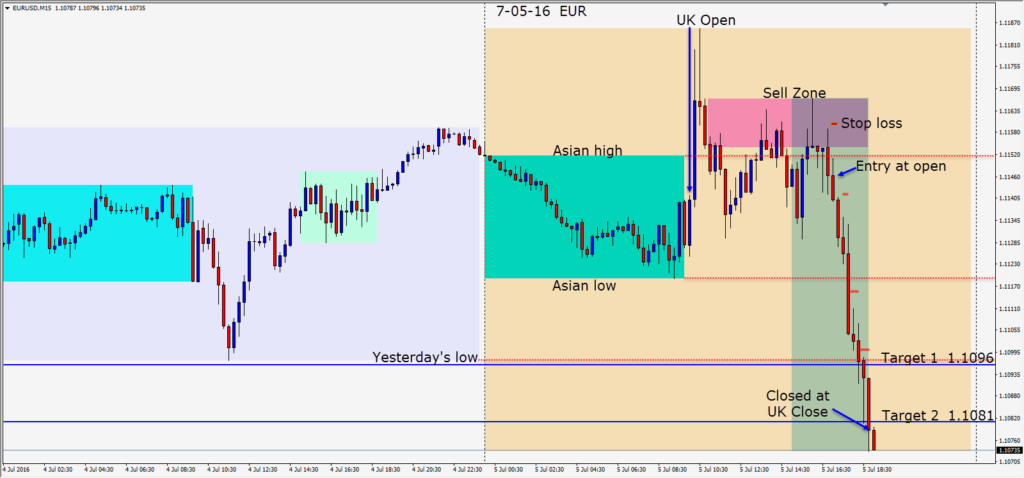

Our bias has been to short the EUR but we are not going to fight the market when it chooses to move higher on any given day.

The EUR has been flirting with some critical levels this week as it moved higher, but has shown no strength to the upside. Fundamentally, in my opinion, there are a number of reasons to short the EUR, but it’s important to wait for the technicals to align before doing so. Today a favourite setup requiring a stop loss risk of only 12 pips created our entry early in the session…but it wasn’t until the U.S. session got underway that it moved nicely downward. As price moved right through yesterday’s low, we gave it lots of room to retest the area, because it’s an area of confluence with the position traders…evidenced on the daily chart. The level was retested as expected before price moved lower and just before the UK Close, we exit as price touches our Target 2.

Good luck with your trading and enjoy your weekend!

Our condolences to the people of France and others affected by yesterday’s tragedy in Nice.