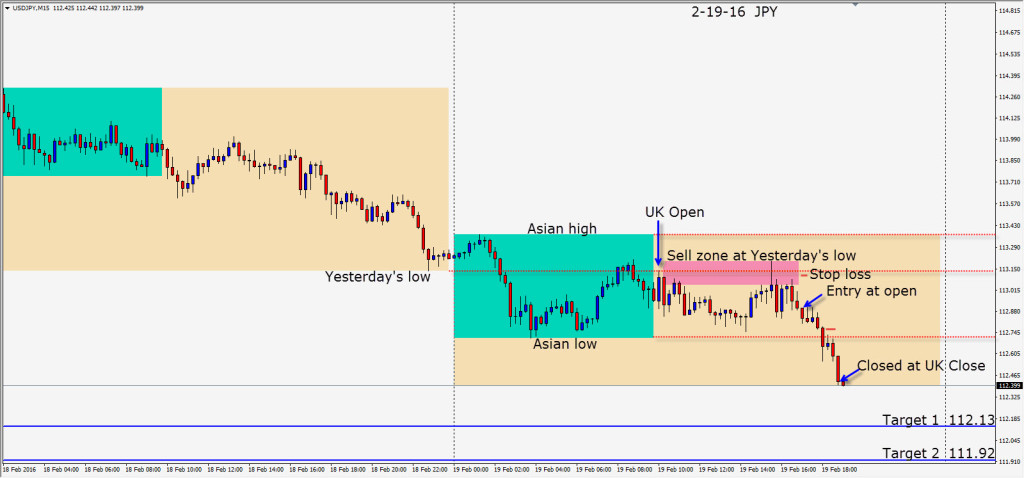

A weaker USD on Friday coupled with a down day for the Nikkei set up a nice short in the USDJPY. Throughout the UK session the pair could not close above yesterday’s low. As it rolled over, we entered short late in the session… risking 21 pips for a potential 98 pips to our Target 2. Price moved down and closed below the Asian session low before retesting the level and moving lower.

As the UK session closed, we exited the trade with nice gains for a 2 hour trade.

Enjoy your weekend!