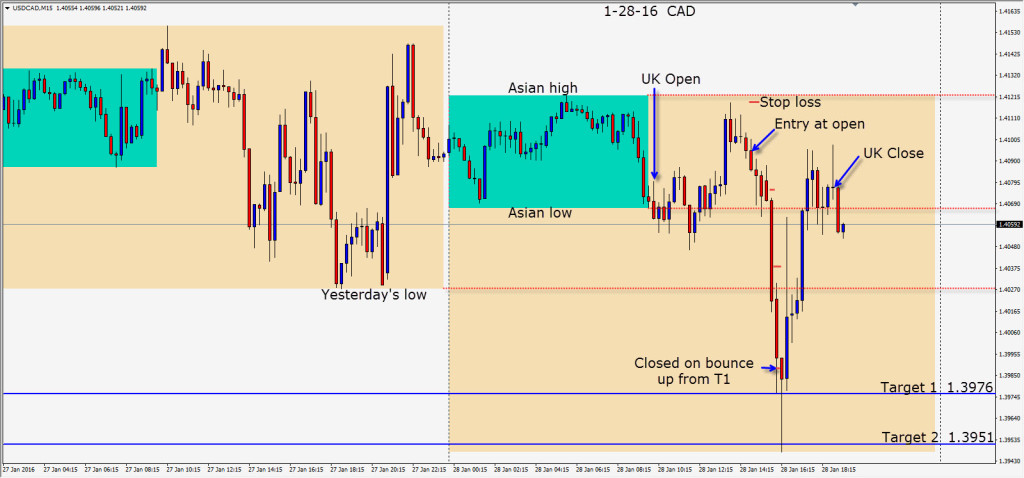

As oil continues to make headlines and remain above the critical $30 level, the CAD continues to strengthen to the USD and its crosses. Today a short is taken in the USDCAD pair as it fails to close above its Asian high and begins to move lower with oil rising in the session…fueling the descent. The move became vertical as price took out its Asian lows. Vertical moves are not sustainable and are susceptible to very abrupt reversals. As price tagged our Target 1 and bounced, we chose to exit for considerable gains… as a long wick began to form.

It’s better to lock in profits than to give them back by being greedy…especially at critical levels.

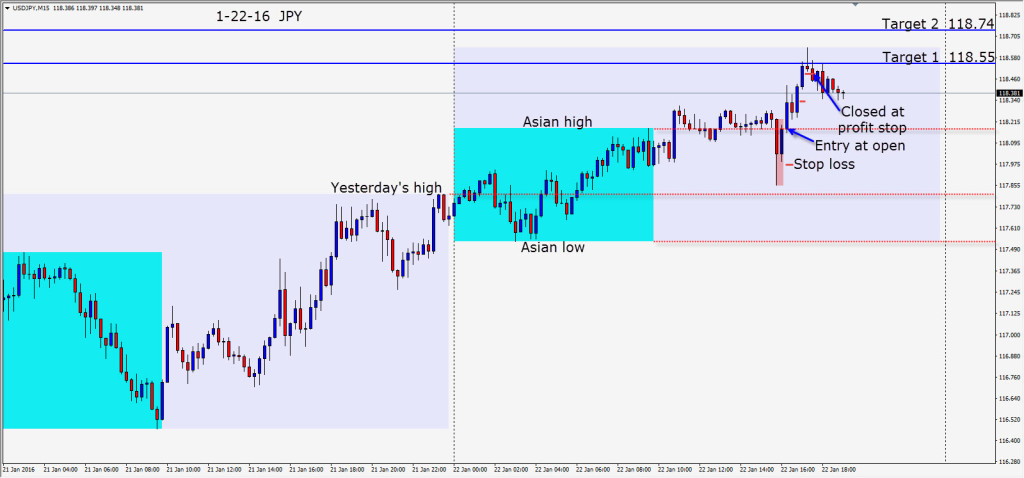

The USDJPY was noticeably subdued awaiting the BOJ.

Good luck with your trading!

Back tomorrow if we find a trade.