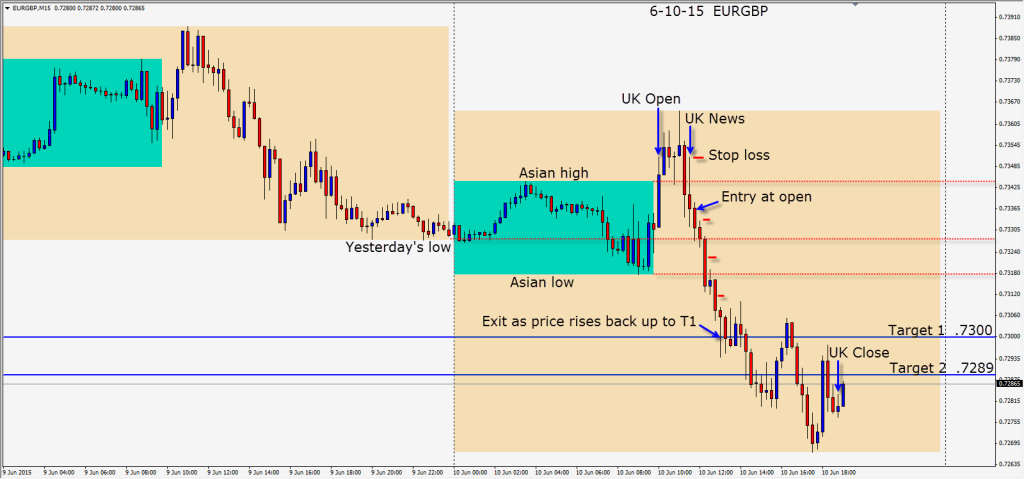

After the UK news the Sterling closed above its Asian high, the EUR closed just below – as did the EURGBP. A EURGBP short is taken on this far from volatile pair. The stop loss was for 15 pips with a 3:1 R/R. Price moved down, closed below its Asian low…retested the level and moved down further. As price moved through our Target 1 which also was the .7300 figure, and began to retest the level we chose to exit the trade. This was a very classic setup.

The Greek situation continues to overshadow the EUR and it appears the market is optimistic that despite the posturing of the politicians, a deal will be worked out. The potential for extreme volatility remains. Surprisingly, the USD has been weak.

Good luck with your trading!

Back tomorrow if we find a trade.