The market was very interested in the NFP number today which was very positive for the U.S. It took a bit of time for the USD to move upward, but the majors eventually turned to reflect a stronger dollar.

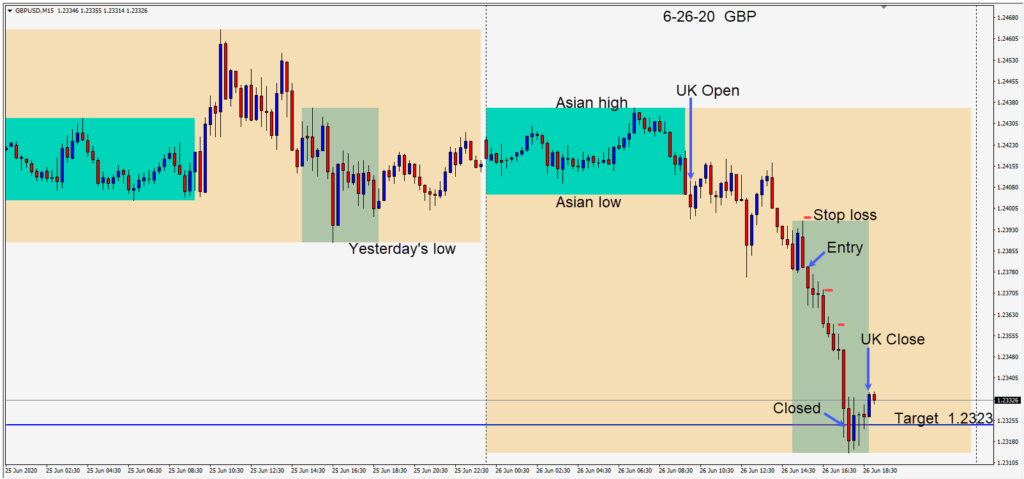

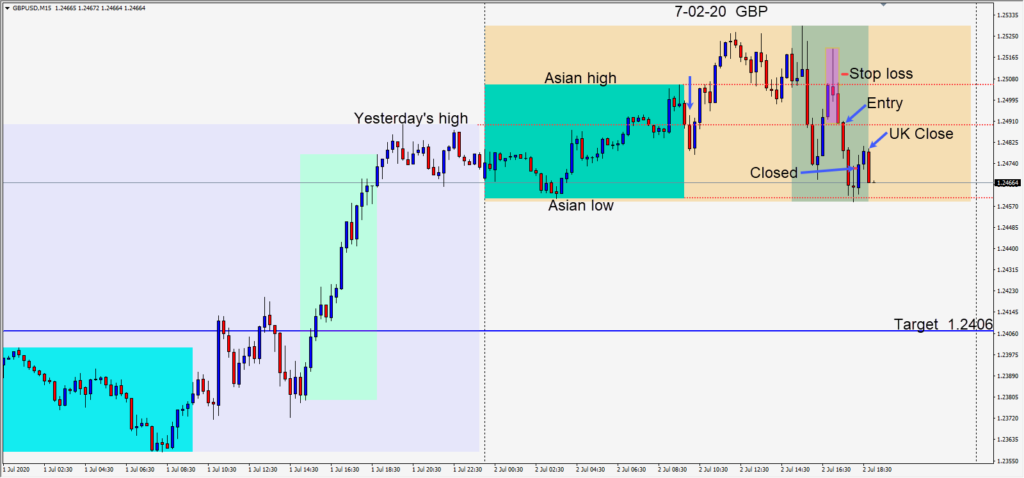

We entered the GBPUSD short risking 20 pips for a potential 83 pips to our daily target at 1.2406. What appeared to be a very nice short setup with good potential stalled out early. Buyers entered at an important technical level from the daily chart and our trade was closed… but at least positive.

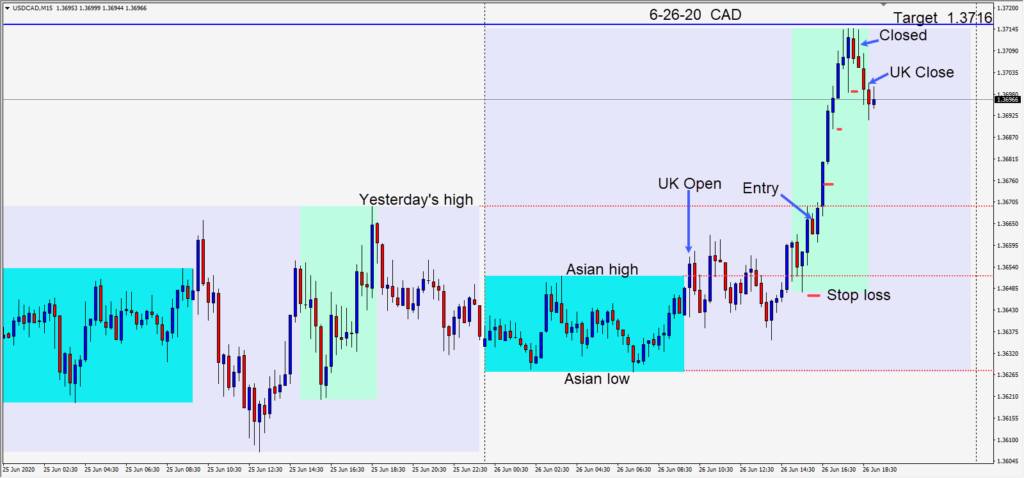

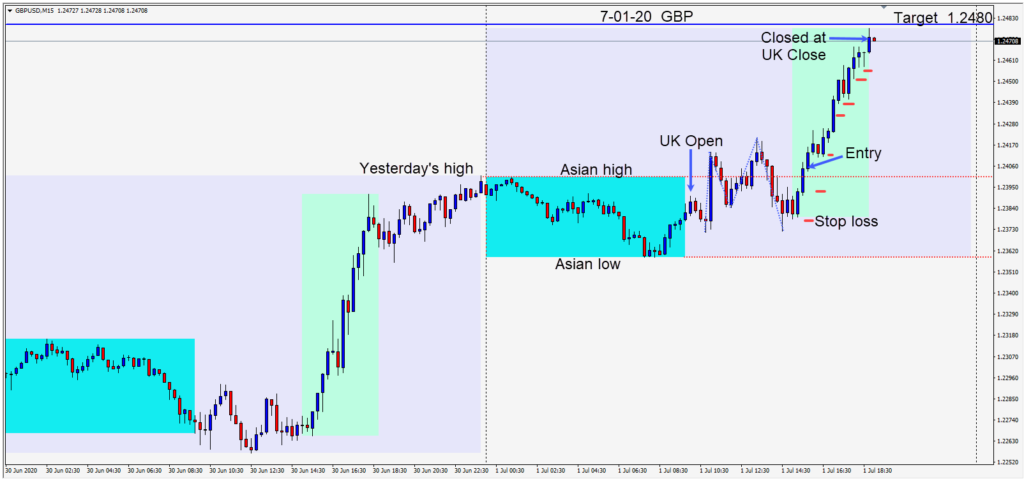

On Wednesday a long was taken risking 27 pips for a potential 75 pips to our daily target at 1.2480.

As price moved up, we locked in more profit and came close to reaching our daily target but we closed the trade at the UK close just shy.

Tomorrow is the U.S. Independence Day holiday.

Good luck with your trading and enjoy your weekend!