Fed Chairman Powell’s dovish wording weakened the USD yesterday. Although the reaction amounted to a quick abrupt sell-off of the dollar, it wasn’t an extreme move. The U.S. economy remains stronger than that of the E.U., U.K. and Japan.

The majors are at or approaching critical technical levels. Tomorrow it will be interesting to see where the pairs close the week after we know the NFP and ISM Manufacturing PMI results.

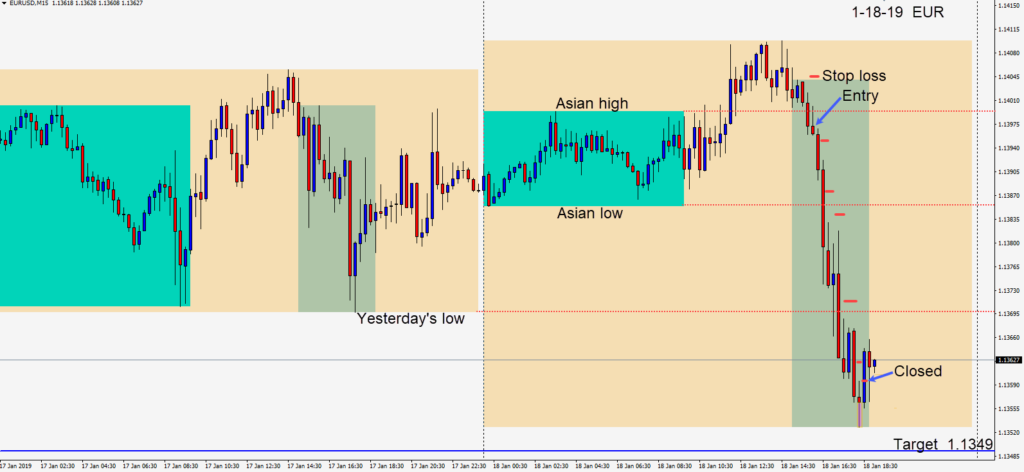

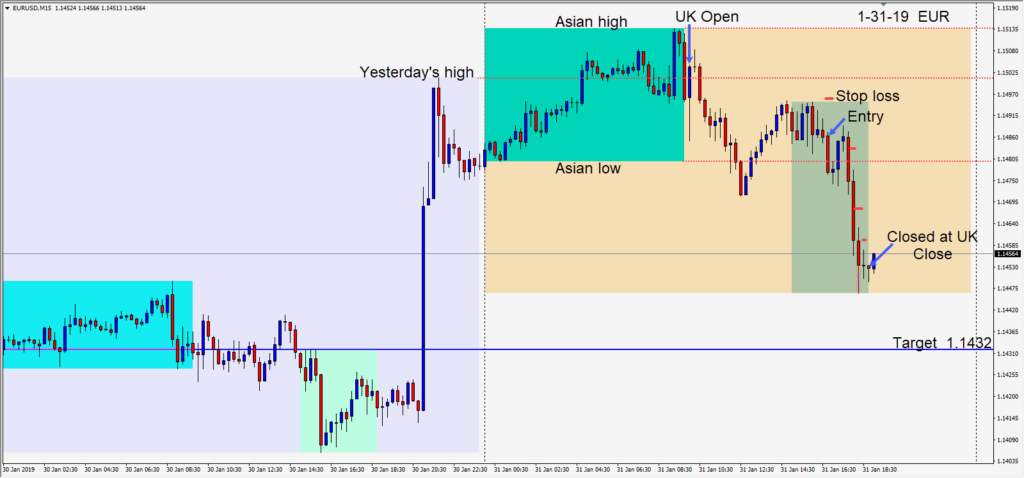

Today as the EURUSD was unable to move higher early in the U.S. session, a short was taken risking 10 pips for a potential 53 pips to our daily target at 1.1432.

Price moved lower but stopped before reaching our target and we closed the trade at the U.K. close. The pair continues to range between 1.1300 and 1.1500.

Be extra cautious tomorrow and anticipate volatility.

Good luck with your trading!