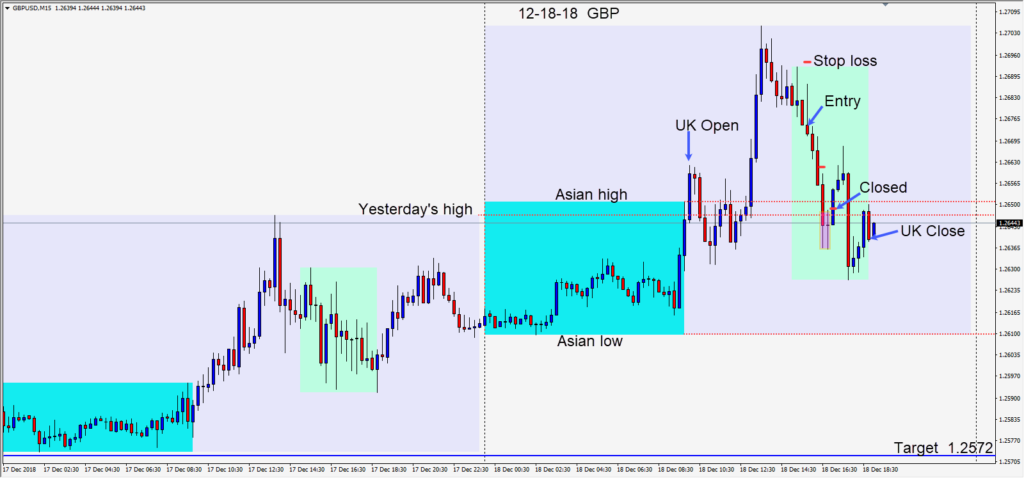

It’s getting very interesting again. In Britain all eyes are on the outcome of the parliamentary vote with wide expectation of defeat for Teresa May. Whenever the GBPUSD rallies, I wait for it to turn and look for a short setup.

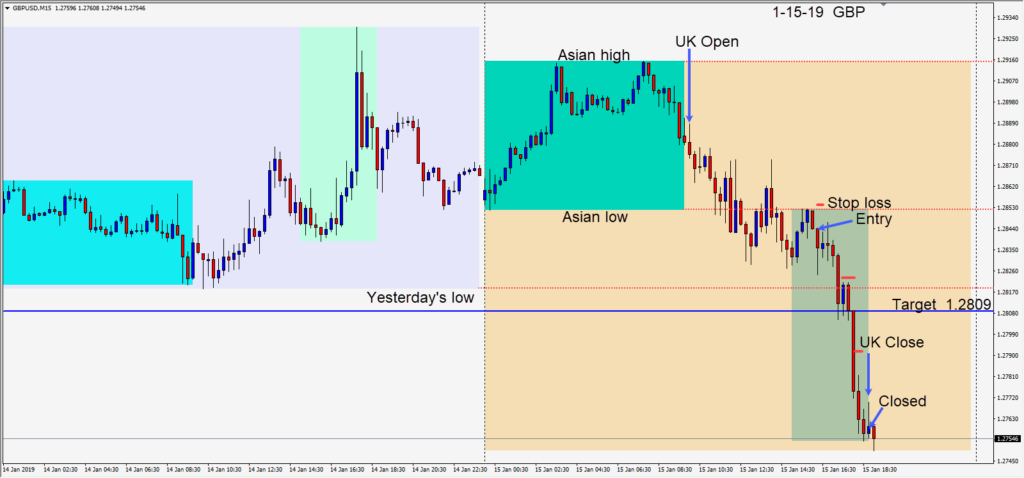

Today with growing negativity and uncertainty ahead of the parliamentary vote, the GBPUSD set up for a modest short. However, it ran further going into the London close. When the U.S. session got underway, price retested its Asian session low and was rejected. Risking 11 pips for a potential 33 pips to our daily target at 1.2809, we went short.

Price moved down as traders considered Britain’s quagmire. It’s very difficult to know how Britain’s exit from the E.U. will transpire and resolve itself, and in the meantime this pair and its crosses will be in the crosshairs. Ultimately Brexit will be resolved and the GBPUSD will climb higher. In the meantime, optimistic rumours will help move it higher and vice versa.

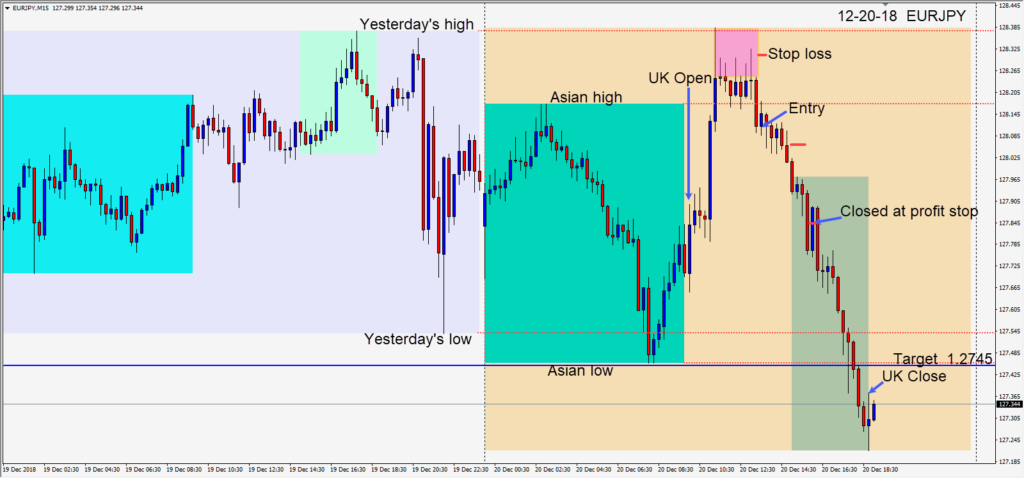

As price moved to our target today, we allowed it to retest yesterday’s low where sellers continued to emerge and we rode it down, closing it at the U.K. close.

Analysts have been making a case for a lower USD and I understand their reasoning, but I don’t agree with it…at least not yet. The Euro remains vulnerable as Mario Draghi hasn’t swayed in his belief that a significant amount of monetary policy stimulation is still needed. Previously, he stated that there would be no interest rate hike through the summer of 2019 and now one might think possibly longer. The U.S. Federal Reserve is likely to raise rates this year if inflation gets above it’s target, regardless of President Trump’s wishes.

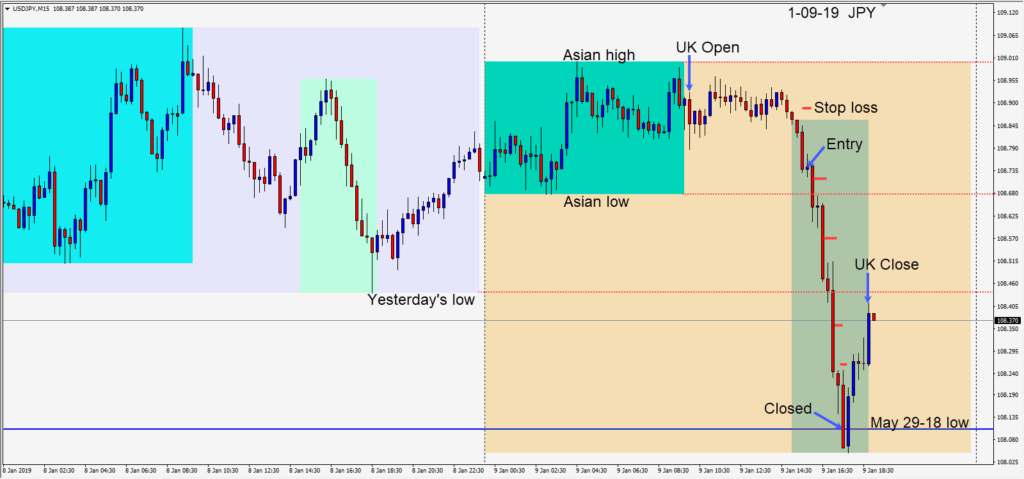

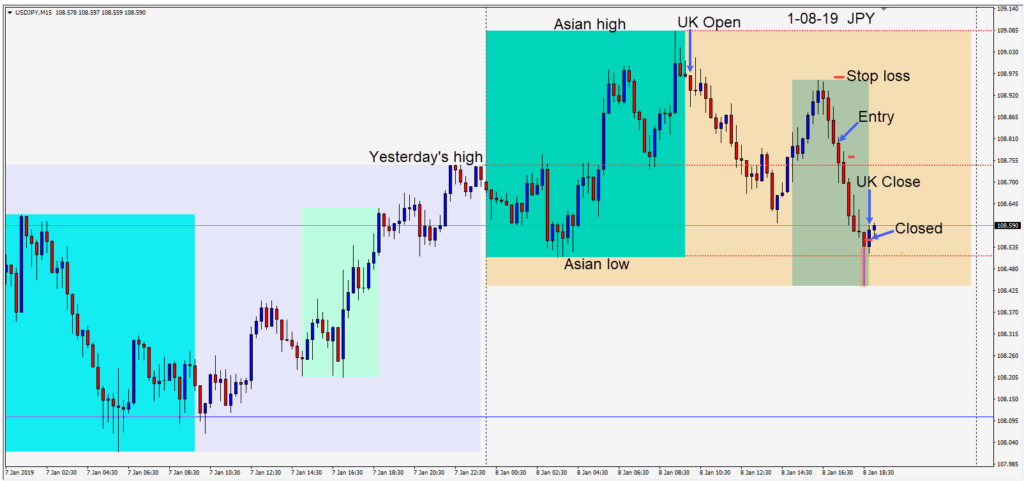

So far, the U.S.-China trade talk rumours continue to be positive and if progress is made, not rumoured to be made, look for the USDJPY to rally and JPY crosses to weaken.

It’s always a two-way market with new information coming to light each day.

Good luck with your trading!