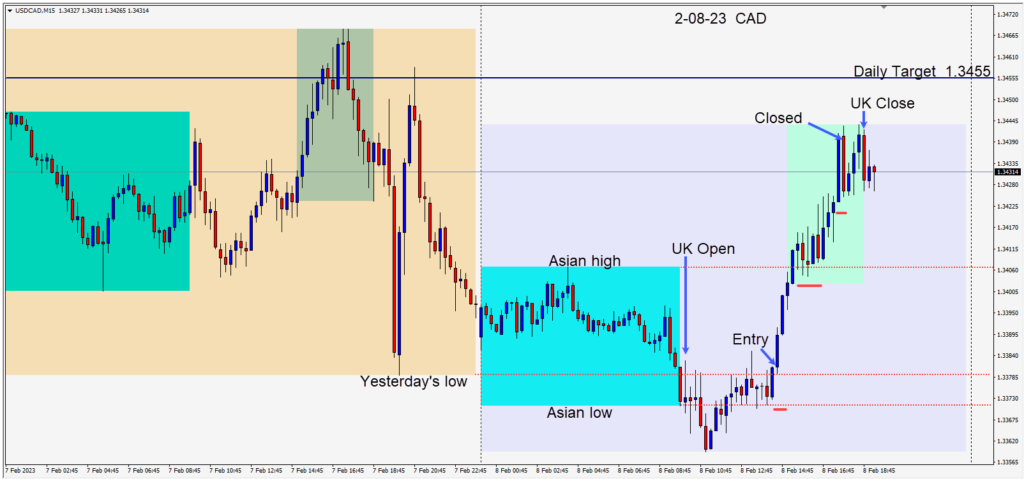

A very bullish candle above its Asian session low set up a long trade in the USDCAD risking 10 pips for a potential 75 pips to our daily target at 1.3455.

An hour before the U.S. session overlap often sees a retracement or profit taking. The USDCAD had been very quiet in the U.K. session and now looked liked it would extend to the upside. There were three technical barriers on the way to our target. The first was the 1.3400 figure followed by technical resistance at 1.3417 and 1.3440.

Price moved higher going into the U.S. open then traded sideways finding support at the Asian session high. It then caught a bid and moved to our third resistance area – from the 4 hr. chart – where it appeared over-extended. We closed the trade on the downtick to protect our profits.

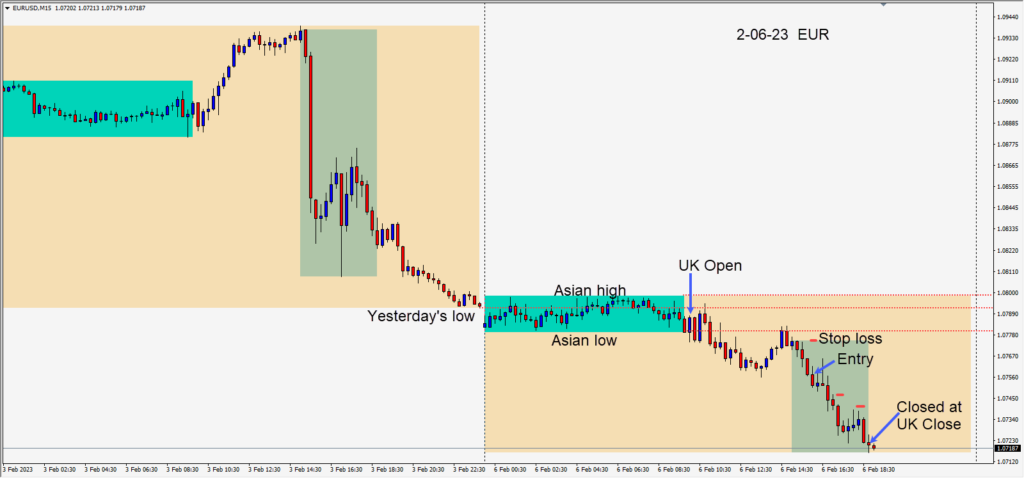

Having given up profit yesterday on a EURUSD short and then getting stopped, I was not in the mood today to give back any profit or to trade the pair.

Thursday’s U.S. Initial Jobless Claims will be closely watched by traders.

Good luck with your trading!