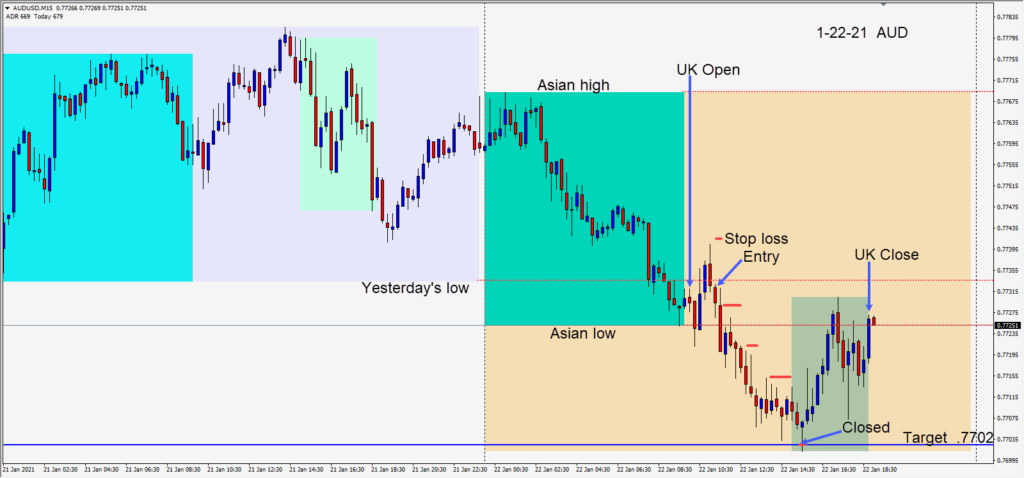

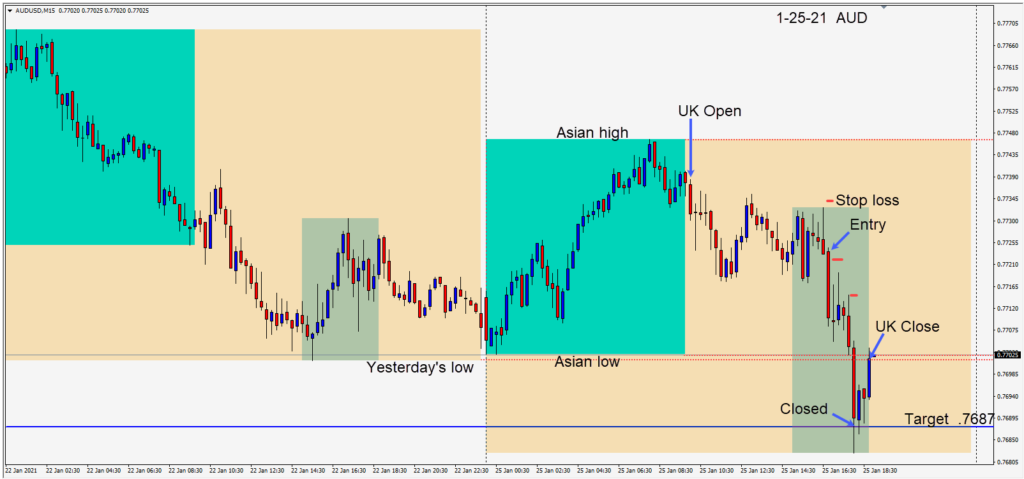

The AUDUSD had moved up in the Asian session, pulled back when the U.K. session got underway, made another attempt to move higher but formed a lower high and faded into the U.S. session open. As the U.S. session got underway, the pair ran into sellers near the .7730 area and made a third lower high.

A short was taken risking 10 pips for a potential 35 pips to our daily target at .7687. Price moved lower to test its Asian session low, Friday’s low and the .7700 figure.

Price continued lower to our target where we exited the trade.

A short on the NZDUSD would have netted a very similar result.

Tuesday we have the CB consumer confidence release in the U.S. and Fed Chair Powell on Wednesday to look forward to.

Good luck with your trading!