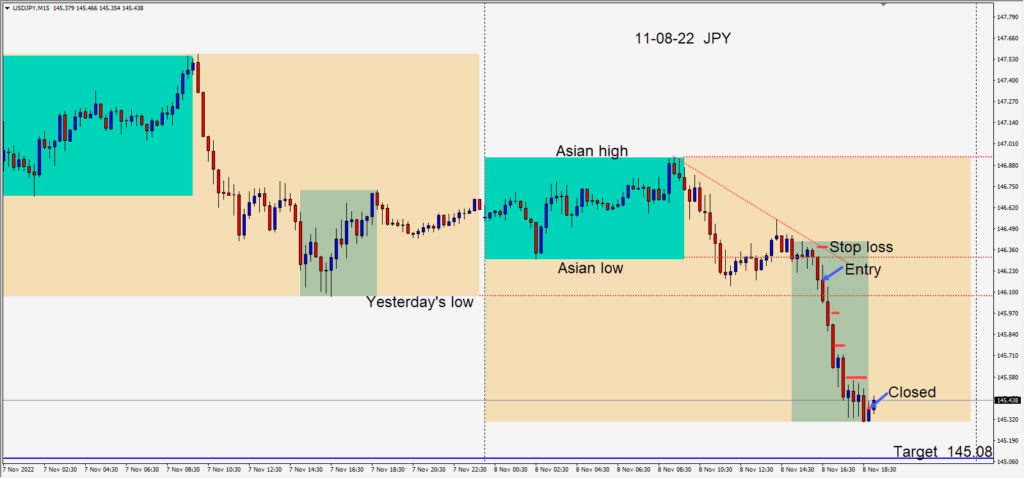

It was a very light economic news calendar today. The DXY moved lower again for a third day in a row and the USDJPY set up for a trade before the other majors today.

The pair had moved lower after the U.K. traders began their day, then made a small retracement in advance of the U.S. session overlap. As the pair began to move lower after the U.S. open, a short was taken risking 22 pips for a potential 108 pips to our daily target at 145.08.

A subsequent short was also taken on the USDCAD (not shown) and this trade was left open after the U.K. close for one candle… which resulted in giving back about 10 pips as the pair retested the 1.3400 level.

Who knows how long it will take to tally the votes for the U.S. midterm elections today… but the results and speculation will be interesting.

Good luck with your trading!