As the market digested President Trump’s speech yesterday and awaited today to see if Fed Chair Powell would add anything new, risk sentiment was cautious.

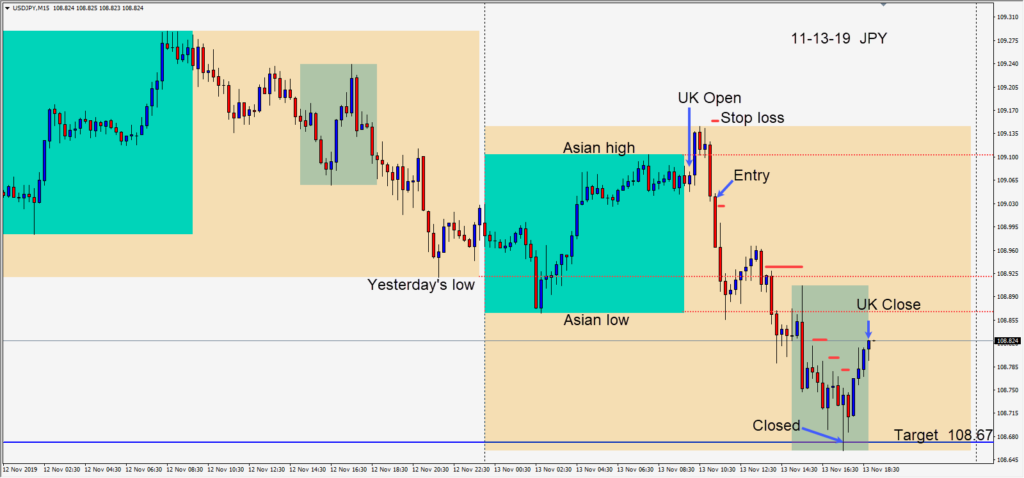

After the USDJPY tried to move above its Asian session high, and failed, a short was taken risking 12 pips for a potential 36 pips to our daily target at 108.67. Price moved down to test its Asian session low and bounced 10 pips higher before making a new wave lower to our daily target.

This pair appears to be moving in a channel between 108.50 and 109.50 at the moment. Look for buyers near 108.50 and sellers near 109.50.

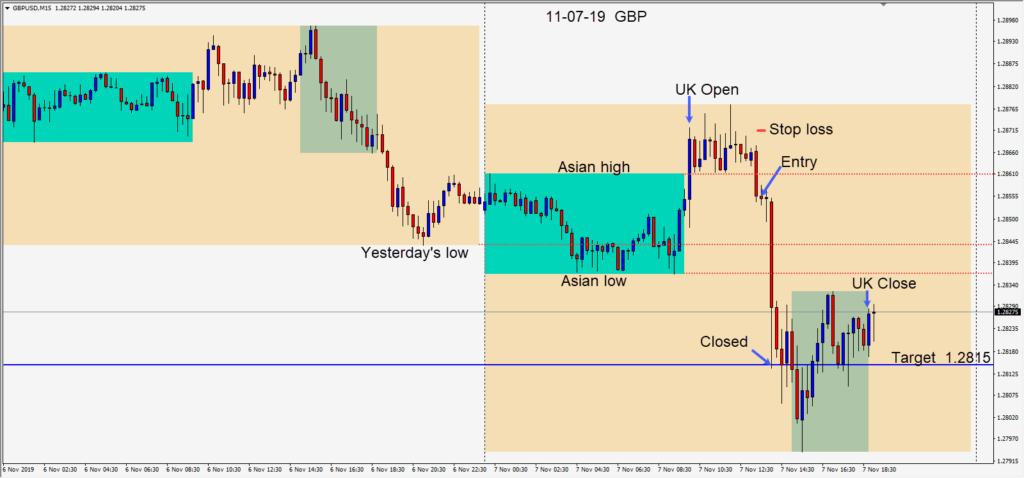

in the U.K. election developments, P.M. Johnson’s Conservatives continue their lead over the Labour party as the prime minister promises to end the Brexit “groundhoggery” and deliver Brexit. In the meantime the pair appears to be trading between 1.2780 to 1.3000. Keep stops tight as the range continues.

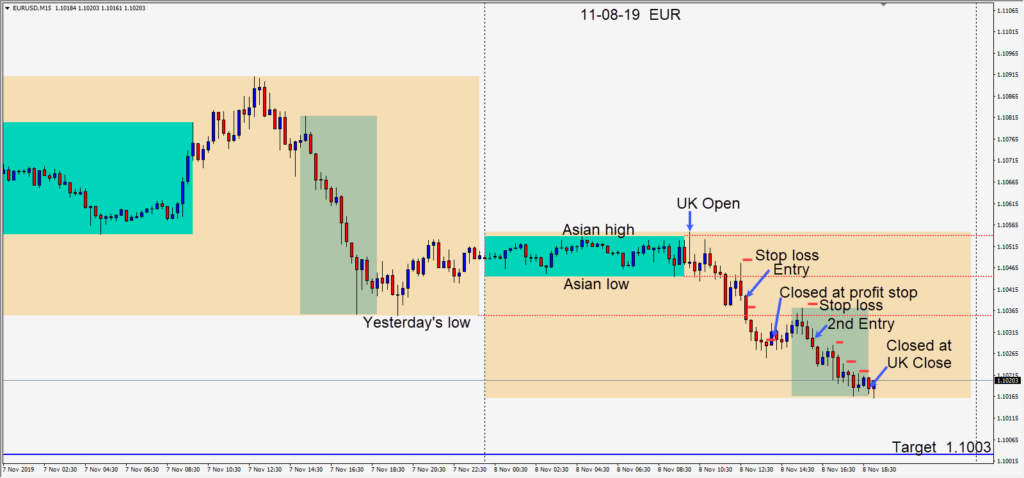

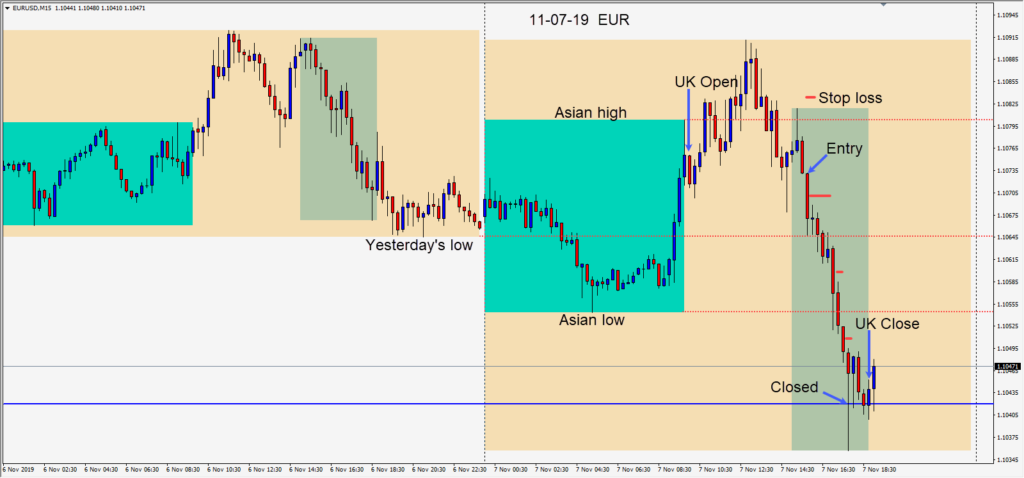

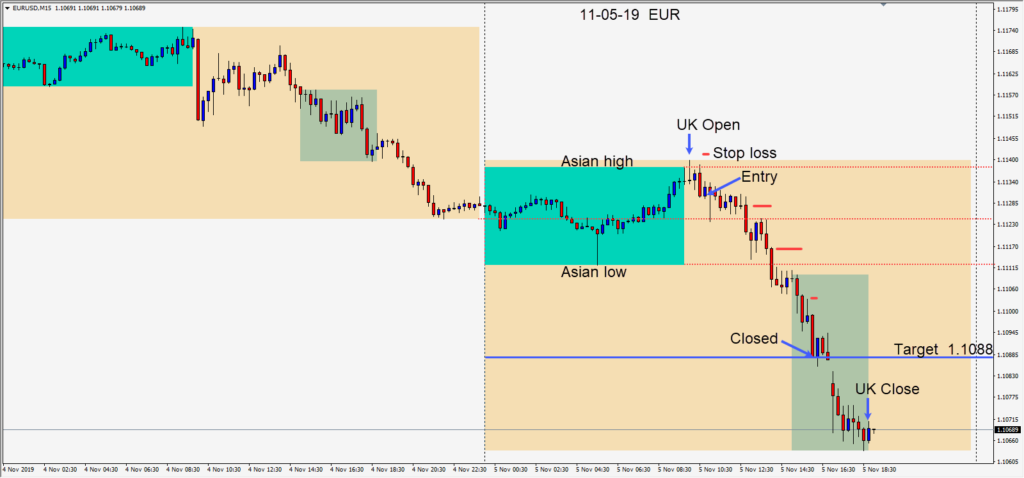

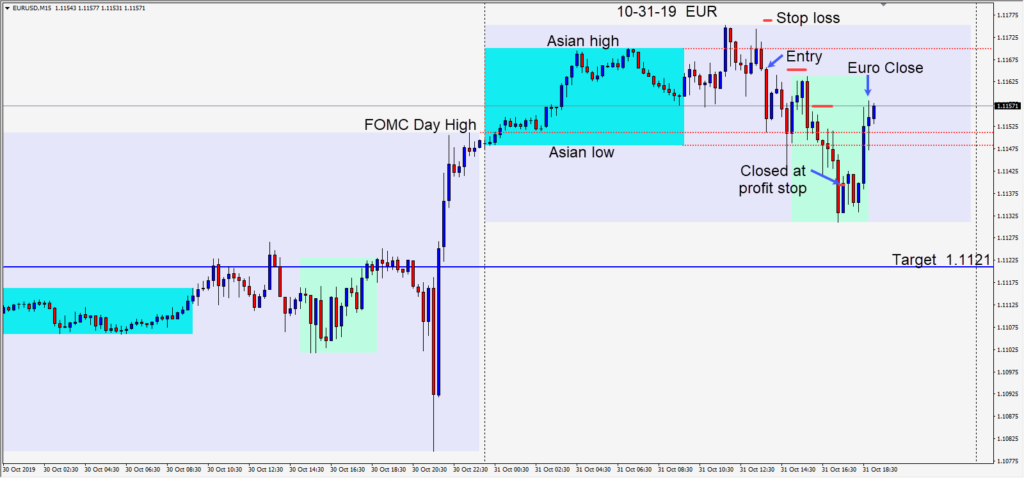

The EURUSD continues to test the 1.1000 level where buyers have been entering. A continued break below, particularly after a retest of 1.1000 opens the 1.0900 and 1.0800 levels for shorts.

Good luck with your trading!