I’m combining two days of trading in one post due to time constraints.

The USD which has been very strong against other currencies finally had a couple of back to back days of weakness.

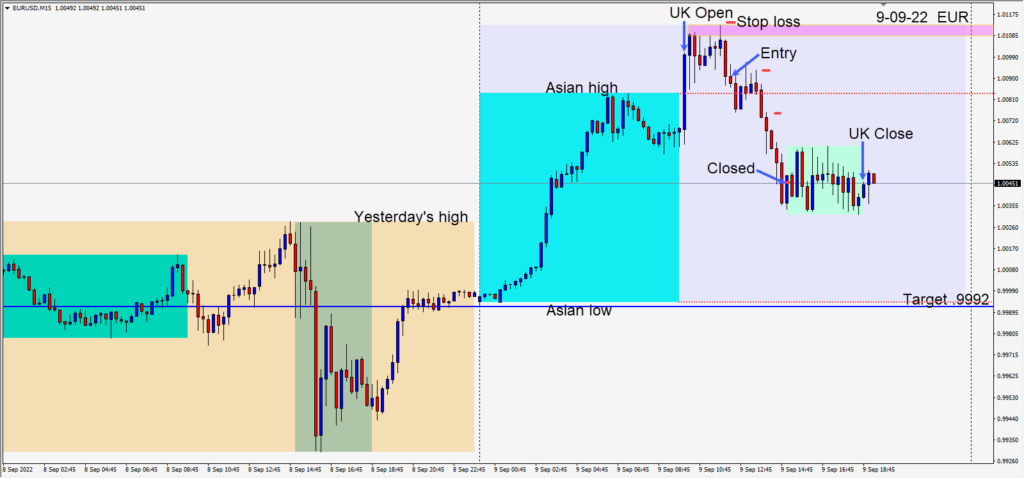

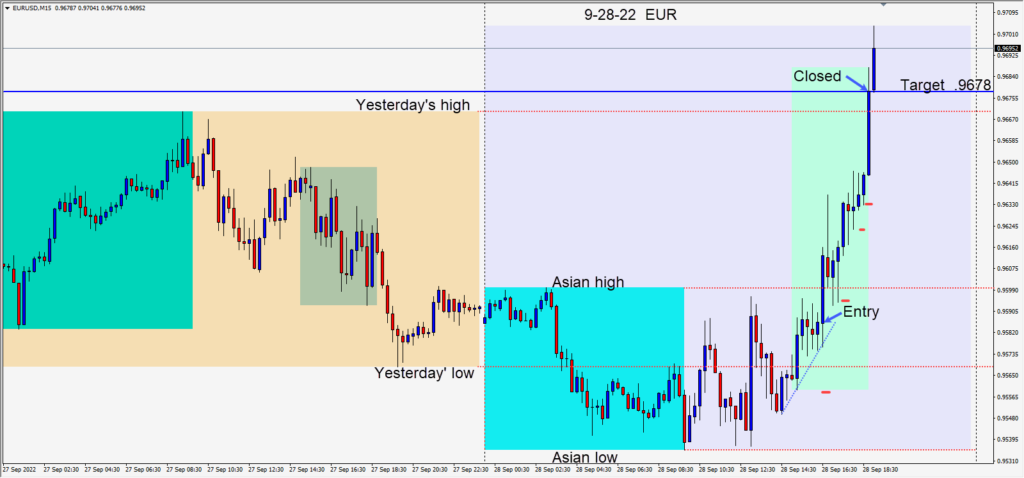

On Wednesday, the EUR found a bottom near .9535 just before the U.K. open, it then made two higher lows and two higher highs before the U.S. session began. As the pair began to move higher an entry was taken risking 27 pips for a potential 92 pips to our daily target at .9678. As this is a countertrend move, we watched price action closely as it reacted to an up-trendline and its Asian session high. Price continued to the upside as the USDX got weaker and weaker. Content to reach either yesterday’s high or our daily target before the U.K close, we exited the trade at .9678.

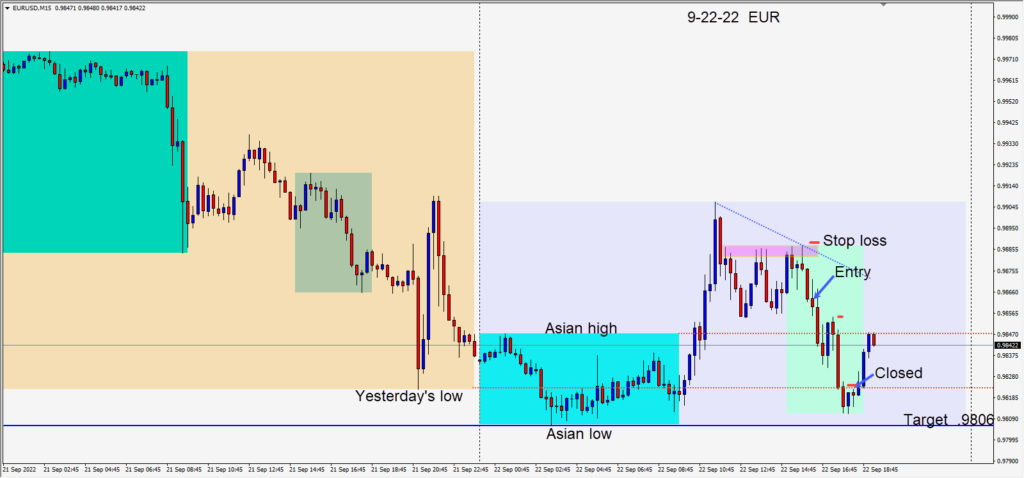

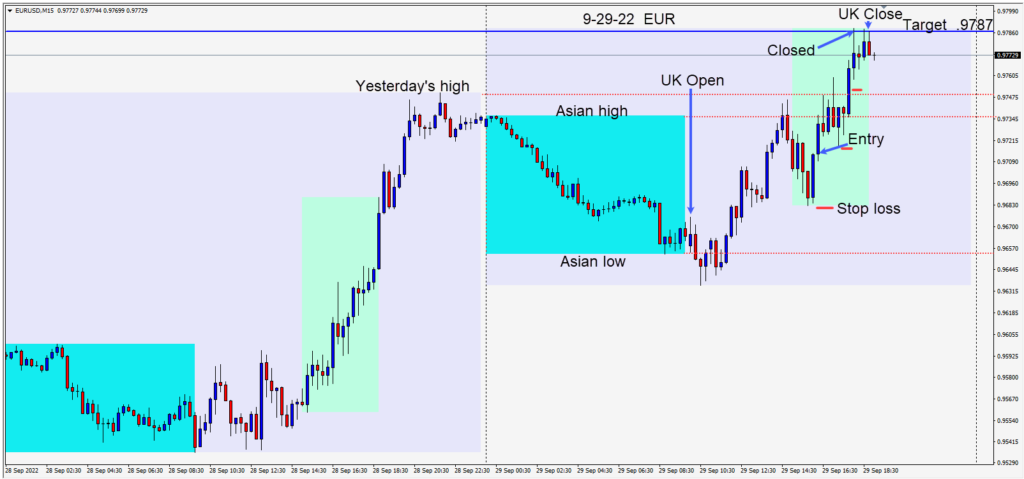

On Wednesday, the USD was weaker for a second day in a row and we took another long trade in the EURUSD. The pair had moved down in the Asian session, made a false breakout lower as the U.K. session got underway and reversed to test its Asian session high… where it failed and pulled back as the U.S. session got underway. After a bullish engulfing candle and a weakening USDX, a long was taken risking 32 pips for a potential 74 pips to our daily target at .9787. A technical level today at .9779 was also a level of concern if price couldn’t get through it. Fortunately price moved to our target just after the European close and our trade was exited.

Friday will be the last trading day of the month and quarter, so there may be extra volatility. With talk of central bank interventions, Japan last week and the U.K. this week, be careful with your stop losses. If the USD continues to weaken, the EURUSD could end up retesting par once again. Currently the pair although technically in a downtrend, could retrace up to .9900 with a softer USD.

Good luck with your trading!