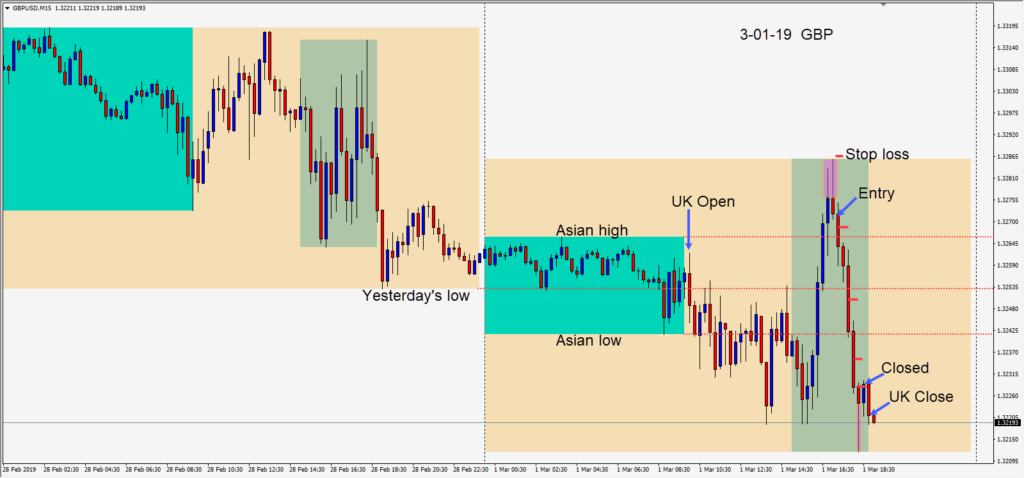

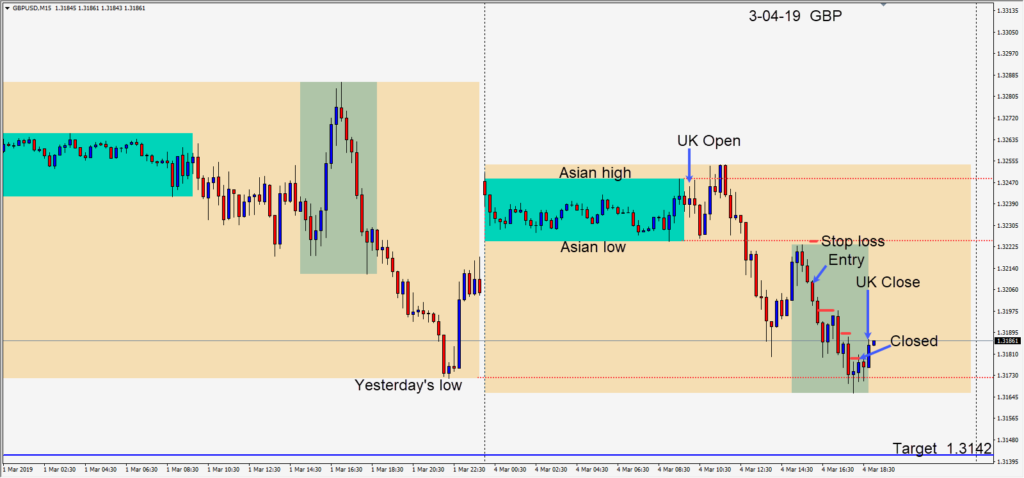

With a stronger USD and the GBPUSD rolling over as the U.S. session got underway, a short was taken risking 16 pips for a potential 66 pips to our daily target at 1.3142.

The pair had gapped higher as the markets reopened this week, oscillated sideways throughout the Asian session and moved mostly lower during the first half of the U.K. session.

Price moved lower as the U.S. session progressed but price was unable to close beneath Friday’s low, as buyers entered moving price up and closing our trade

Where will the USD go from here? President Trump’s criticisms of Fed Chair Powell did little to weaken the USD. Although modestly stronger today, events this week including a number of economic releases scheduled for Tuesday, the outcome of the ECB on Thursday, followed by the NFP number on Friday may cause some volatility. The market remains very optimistic about the U.S. – China trade talks outcome by month end.

Good luck with your trading!