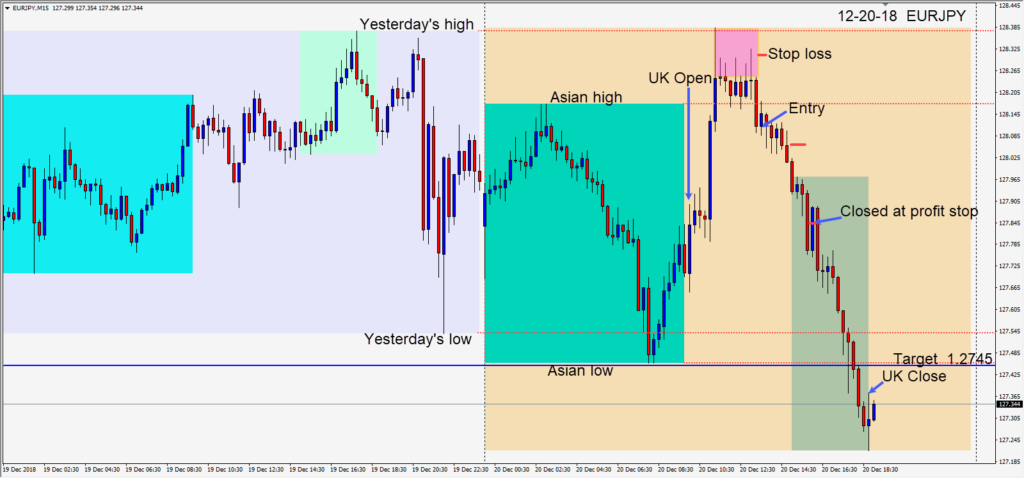

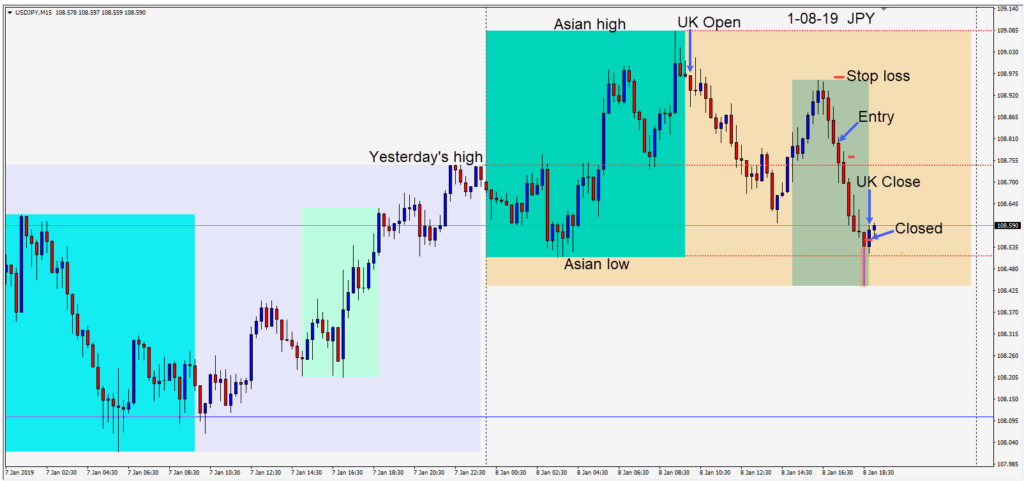

Equity markets were stronger today as was the USD. Early in the U.S. session the USDJPY made a lower high and began moving down. We entered short risking 16 pips hoping to get at least 32 pips before the London session ended.

Price moved down to yesterday’s high and we moved our profit stop just above this level to allow for a retest. Price continued lower to test its Asian session low and found buyers leaving a candle with a long lower wick. Not wanting to give back too many pips, we moved the profit stop just above the Asian low and as price moved higher the trade closed just before the U.K. close.

As the new year begins, traders will be focusing on the U.S. – China trade talks and Jerome Powell’s speech on Thursday. There are a number of significant economic news releases scheduled this week so be careful of the potential for volatility.

Like the Federal Reserve be flexible in your outlook.

Happy New Year and good luck with your trading!