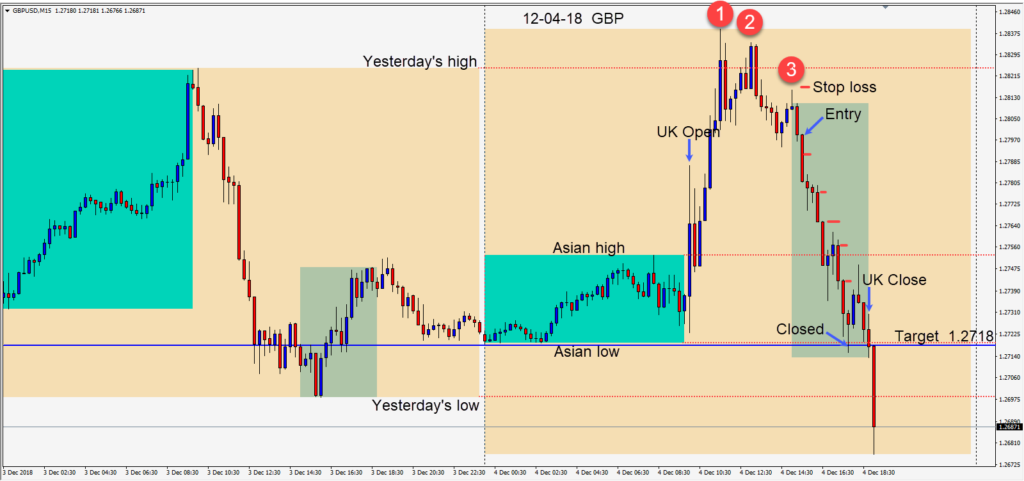

The GBPUSD is a very active pair lately with all the concerns surrounding Brexit. It is also potentially very volatile and is best traded with very tight stop losses. Having moved higher in a countertrend move early in the U.K. session and having made its topside range, it would likely set up for a short and a move back down… in the direction of its trend.

During the second half of the session, the pair made a lower high and an entry short was taken risking 17 pips for a potential 93 pips to our daily target at 1.2671. As price moved lower, we removed the risk from the trade and continued to lock in profit. The pair moved down with a candle closing beneath its Asian high. We allowed for a retest of this level but the bounce higher closed the trade as buyers emerged.

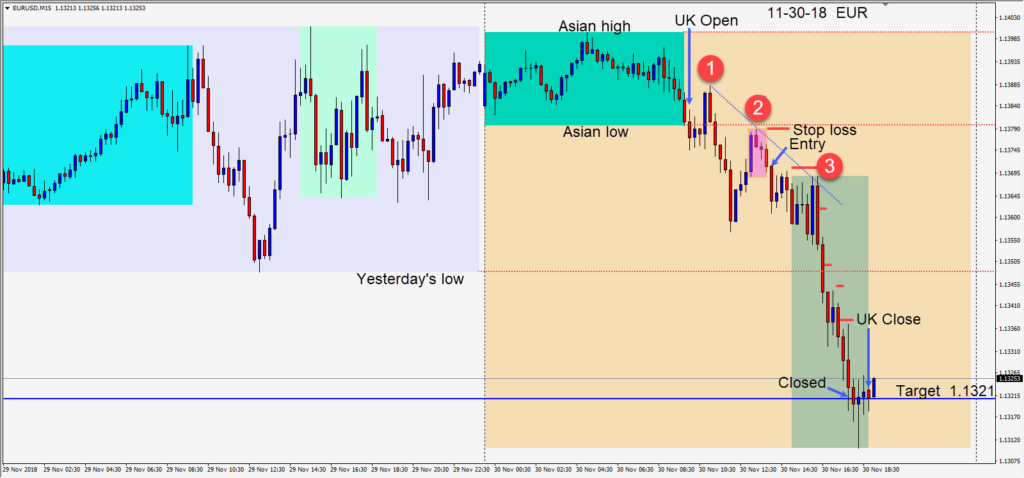

U.S. markets were closed today to honour former President George H.W. Bush.

The USDCAD continued higher as the Bank of Canada left interest rates unchanged today and oil prices remain about 25% off their recent highs. With talk of production cuts, it remains unclear as to when the oil producing countries will start their cuts and what President Trump will tweet if oil begins to trend upward.

Good luck with your trading!